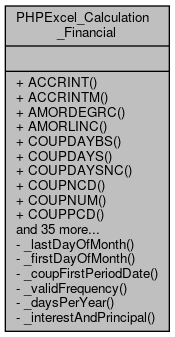

Collaboration diagram for PHPExcel_Calculation_Financial:

Collaboration diagram for PHPExcel_Calculation_Financial:Static Public Member Functions | |

| static | ACCRINT ($issue, $firstinterest, $settlement, $rate, $par=1000, $frequency=1, $basis=0) |

| static | ACCRINTM ($issue, $settlement, $rate, $par=1000, $basis=0) |

| static | AMORDEGRC ($cost, $purchased, $firstPeriod, $salvage, $period, $rate, $basis=0) |

| static | AMORLINC ($cost, $purchased, $firstPeriod, $salvage, $period, $rate, $basis=0) |

| static | COUPDAYBS ($settlement, $maturity, $frequency, $basis=0) |

| static | COUPDAYS ($settlement, $maturity, $frequency, $basis=0) |

| static | COUPDAYSNC ($settlement, $maturity, $frequency, $basis=0) |

| static | COUPNCD ($settlement, $maturity, $frequency, $basis=0) |

| static | COUPNUM ($settlement, $maturity, $frequency, $basis=0) |

| static | COUPPCD ($settlement, $maturity, $frequency, $basis=0) |

| static | CUMIPMT ($rate, $nper, $pv, $start, $end, $type=0) |

| static | CUMPRINC ($rate, $nper, $pv, $start, $end, $type=0) |

| static | DB ($cost, $salvage, $life, $period, $month=12) |

| static | DDB ($cost, $salvage, $life, $period, $factor=2.0) |

| static | DISC ($settlement, $maturity, $price, $redemption, $basis=0) |

| static | DOLLARDE ($fractional_dollar=Null, $fraction=0) |

| static | DOLLARFR ($decimal_dollar=Null, $fraction=0) |

| static | EFFECT ($nominal_rate=0, $npery=0) |

| static | FV ($rate=0, $nper=0, $pmt=0, $pv=0, $type=0) |

| static | FVSCHEDULE ($principal, $schedule) |

| FVSCHEDULE. More... | |

| static | INTRATE ($settlement, $maturity, $investment, $redemption, $basis=0) |

| INTRATE. More... | |

| static | IPMT ($rate, $per, $nper, $pv, $fv=0, $type=0) |

| IPMT. More... | |

| static | IRR ($values, $guess=0.1) |

| IRR. More... | |

| static | ISPMT () |

| ISPMT. More... | |

| static | MIRR ($values, $finance_rate, $reinvestment_rate) |

| MIRR. More... | |

| static | NOMINAL ($effect_rate=0, $npery=0) |

| NOMINAL. More... | |

| static | NPER ($rate=0, $pmt=0, $pv=0, $fv=0, $type=0) |

| NPER. More... | |

| static | NPV () |

| NPV. More... | |

| static | PMT ($rate=0, $nper=0, $pv=0, $fv=0, $type=0) |

| PMT. More... | |

| static | PPMT ($rate, $per, $nper, $pv, $fv=0, $type=0) |

| PPMT. More... | |

| static | PRICE ($settlement, $maturity, $rate, $yield, $redemption, $frequency, $basis=0) |

| static | PRICEDISC ($settlement, $maturity, $discount, $redemption, $basis=0) |

| PRICEDISC. More... | |

| static | PRICEMAT ($settlement, $maturity, $issue, $rate, $yield, $basis=0) |

| PRICEMAT. More... | |

| static | PV ($rate=0, $nper=0, $pmt=0, $fv=0, $type=0) |

| PV. More... | |

| static | RATE ($nper, $pmt, $pv, $fv=0.0, $type=0, $guess=0.1) |

| static | RECEIVED ($settlement, $maturity, $investment, $discount, $basis=0) |

| RECEIVED. More... | |

| static | SLN ($cost, $salvage, $life) |

| SLN. More... | |

| static | SYD ($cost, $salvage, $life, $period) |

| SYD. More... | |

| static | TBILLEQ ($settlement, $maturity, $discount) |

| TBILLEQ. More... | |

| static | TBILLPRICE ($settlement, $maturity, $discount) |

| TBILLPRICE. More... | |

| static | TBILLYIELD ($settlement, $maturity, $price) |

| TBILLYIELD. More... | |

| static | XIRR ($values, $dates, $guess=0.1) |

| static | XNPV ($rate, $values, $dates) |

| XNPV. More... | |

| static | YIELDDISC ($settlement, $maturity, $price, $redemption, $basis=0) |

| YIELDDISC. More... | |

| static | YIELDMAT ($settlement, $maturity, $issue, $rate, $price, $basis=0) |

| YIELDMAT. More... | |

Static Private Member Functions | |

| static | _lastDayOfMonth ($testDate) |

| _lastDayOfMonth More... | |

| static | _firstDayOfMonth ($testDate) |

| _firstDayOfMonth More... | |

| static | _coupFirstPeriodDate ($settlement, $maturity, $frequency, $next) |

| static | _validFrequency ($frequency) |

| static | _daysPerYear ($year, $basis=0) |

| _daysPerYear More... | |

| static | _interestAndPrincipal ($rate=0, $per=0, $nper=0, $pv=0, $fv=0, $type=0) |

Detailed Description

Definition at line 53 of file Financial.php.

Member Function Documentation

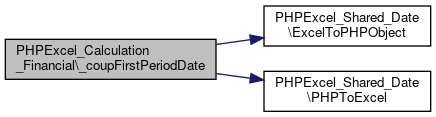

◆ _coupFirstPeriodDate()

|

staticprivate |

Definition at line 83 of file Financial.php.

References $result, _lastDayOfMonth(), PHPExcel_Shared_Date\ExcelToPHPObject(), and PHPExcel_Shared_Date\PHPToExcel().

Referenced by COUPDAYBS(), COUPDAYS(), COUPDAYSNC(), COUPNCD(), COUPNUM(), and COUPPCD().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

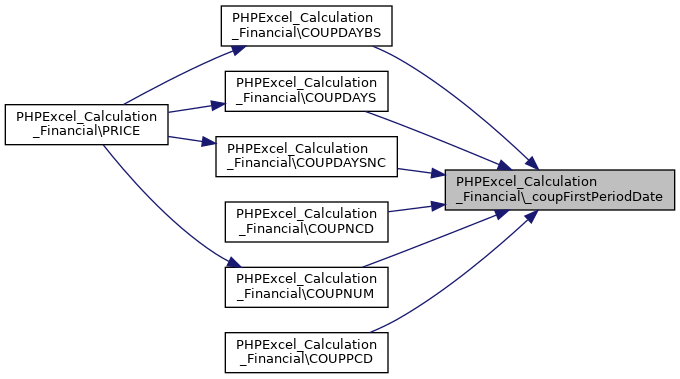

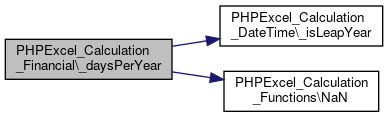

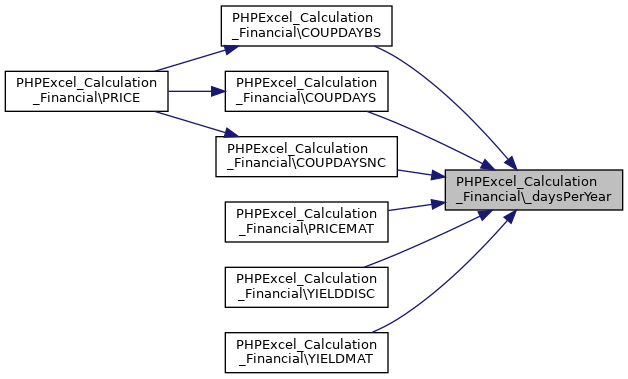

Here is the caller graph for this function:◆ _daysPerYear()

|

staticprivate |

_daysPerYear

Returns the number of days in a specified year, as defined by the "basis" value

- Parameters

-

integer $year The year against which we're testing integer $basis The type of day count: 0 or omitted US (NASD) 360 1 Actual (365 or 366 in a leap year) 2 360 3 365 4 European 360

- Returns

- integer

Definition at line 132 of file Financial.php.

References PHPExcel_Calculation_DateTime\_isLeapYear(), and PHPExcel_Calculation_Functions\NaN().

Referenced by COUPDAYBS(), COUPDAYS(), COUPDAYSNC(), PRICEMAT(), YIELDDISC(), and YIELDMAT().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ _firstDayOfMonth()

|

staticprivate |

_firstDayOfMonth

Returns a boolean TRUE/FALSE indicating if this date is the first date of the month

- Parameters

-

DateTime $testDate The date for testing

- Returns

- boolean

Definition at line 77 of file Financial.php.

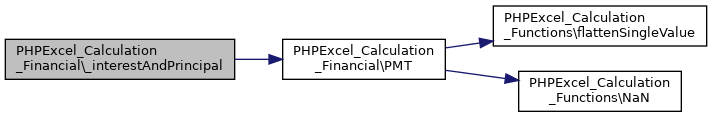

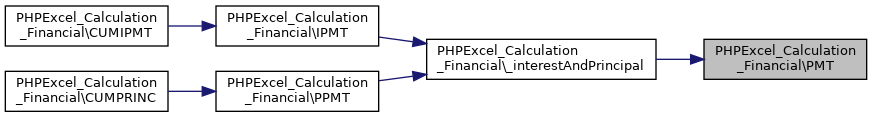

◆ _interestAndPrincipal()

|

staticprivate |

Definition at line 153 of file Financial.php.

References PMT().

Referenced by IPMT(), and PPMT().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

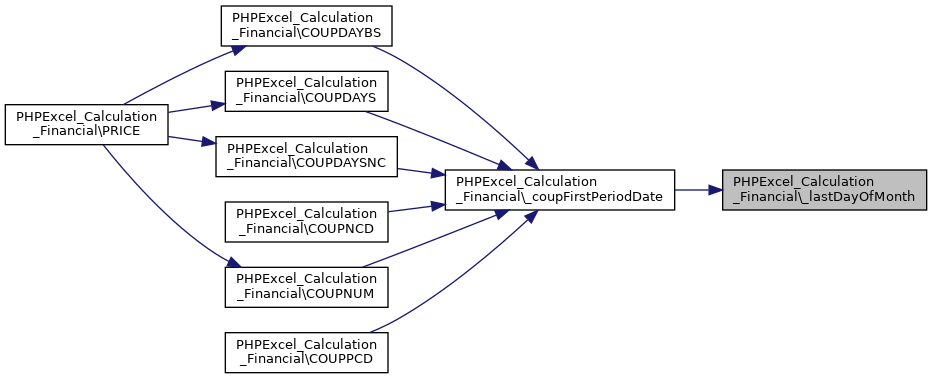

Here is the caller graph for this function:◆ _lastDayOfMonth()

|

staticprivate |

_lastDayOfMonth

Returns a boolean TRUE/FALSE indicating if this date is the last date of the month

- Parameters

-

DateTime $testDate The date for testing

- Returns

- boolean

Definition at line 63 of file Financial.php.

Referenced by _coupFirstPeriodDate().

Here is the caller graph for this function:

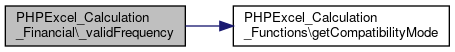

Here is the caller graph for this function:◆ _validFrequency()

|

staticprivate |

Definition at line 105 of file Financial.php.

References PHPExcel_Calculation_Functions\COMPATIBILITY_GNUMERIC, and PHPExcel_Calculation_Functions\getCompatibilityMode().

Here is the call graph for this function:

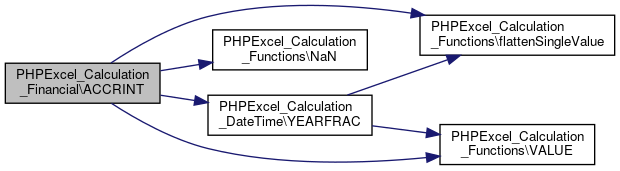

Here is the call graph for this function:◆ ACCRINT()

|

static |

Definition at line 201 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

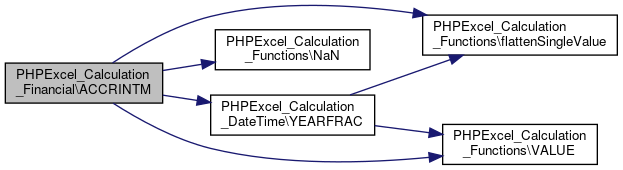

Here is the call graph for this function:◆ ACCRINTM()

|

static |

Definition at line 253 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

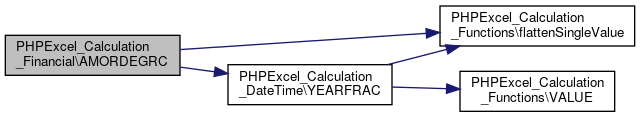

Here is the call graph for this function:◆ AMORDEGRC()

|

static |

Definition at line 309 of file Financial.php.

References $n, PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

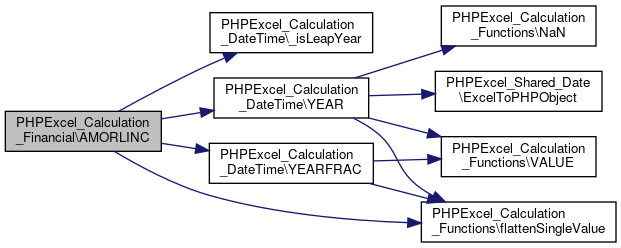

Here is the call graph for this function:◆ AMORLINC()

|

static |

Definition at line 385 of file Financial.php.

References PHPExcel_Calculation_DateTime\_isLeapYear(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

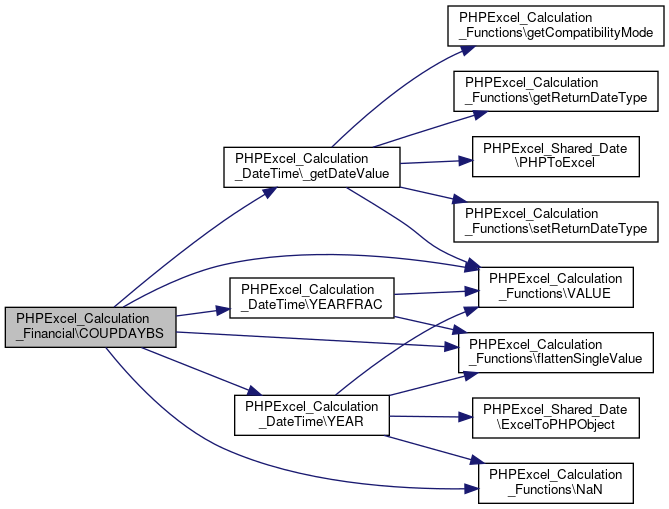

Here is the call graph for this function:◆ COUPDAYBS()

|

static |

Definition at line 451 of file Financial.php.

References _coupFirstPeriodDate(), _daysPerYear(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Referenced by PRICE().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

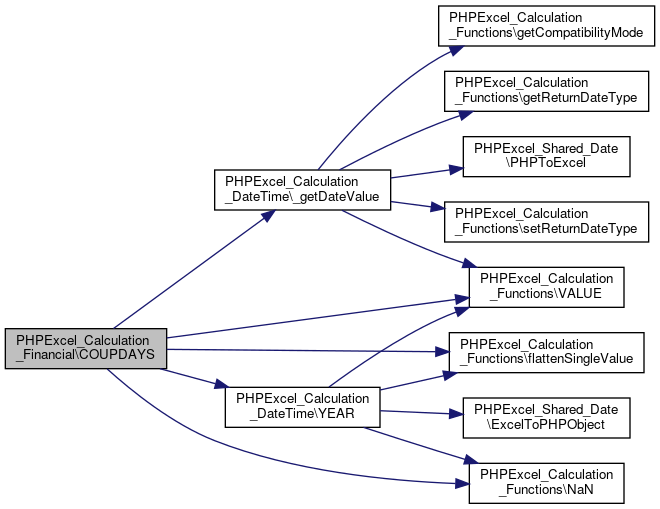

Here is the caller graph for this function:◆ COUPDAYS()

|

static |

Definition at line 509 of file Financial.php.

References _coupFirstPeriodDate(), _daysPerYear(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEAR().

Referenced by PRICE().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

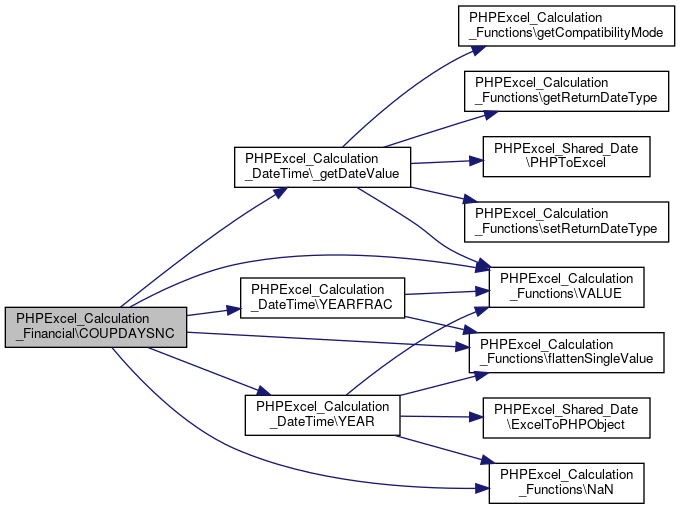

Here is the caller graph for this function:◆ COUPDAYSNC()

|

static |

Definition at line 579 of file Financial.php.

References _coupFirstPeriodDate(), _daysPerYear(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Referenced by PRICE().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

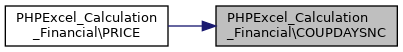

Here is the caller graph for this function:◆ COUPNCD()

|

static |

Definition at line 638 of file Financial.php.

References _coupFirstPeriodDate(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

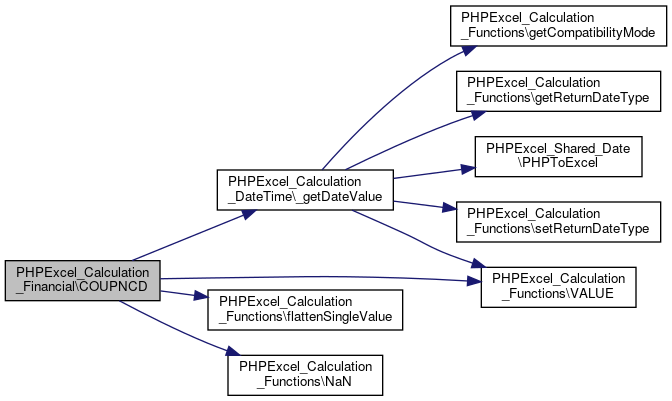

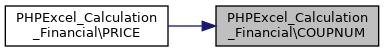

Here is the call graph for this function:◆ COUPNUM()

|

static |

Definition at line 694 of file Financial.php.

References _coupFirstPeriodDate(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Referenced by PRICE().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ COUPPCD()

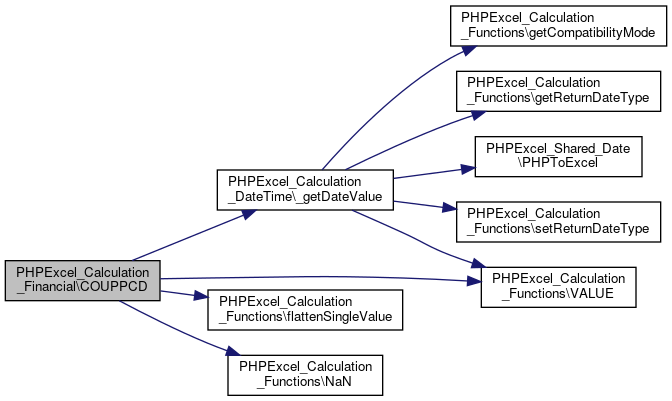

|

static |

Definition at line 765 of file Financial.php.

References _coupFirstPeriodDate(), PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

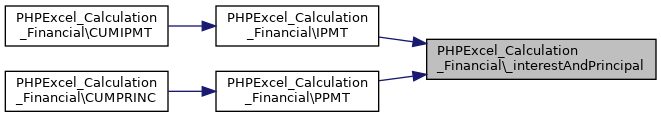

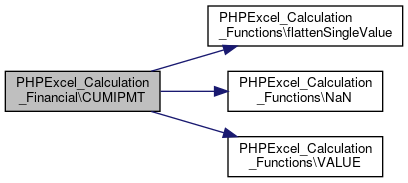

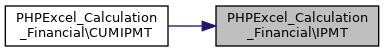

Here is the call graph for this function:◆ CUMIPMT()

|

static |

Definition at line 809 of file Financial.php.

References $start, PHPExcel_Calculation_Functions\flattenSingleValue(), IPMT(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

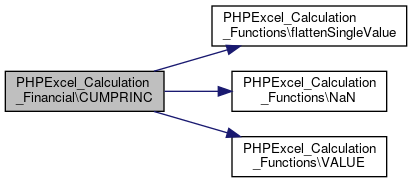

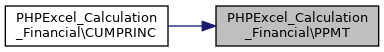

Here is the call graph for this function:◆ CUMPRINC()

|

static |

Definition at line 856 of file Financial.php.

References $start, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PPMT(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

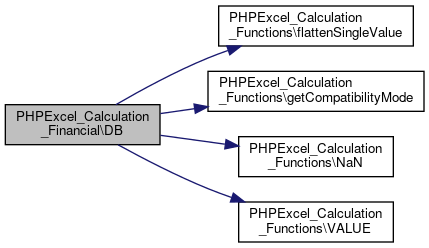

Here is the call graph for this function:◆ DB()

|

static |

Definition at line 908 of file Financial.php.

References PHPExcel_Calculation_Functions\COMPATIBILITY_GNUMERIC, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\getCompatibilityMode(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

Here is the call graph for this function:◆ DDB()

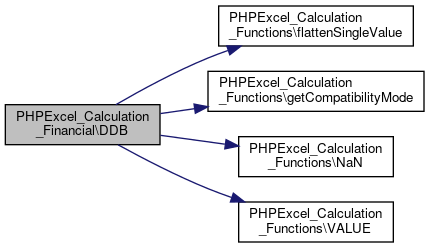

|

static |

Definition at line 975 of file Financial.php.

References PHPExcel_Calculation_Functions\COMPATIBILITY_GNUMERIC, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\getCompatibilityMode(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

Here is the call graph for this function:◆ DISC()

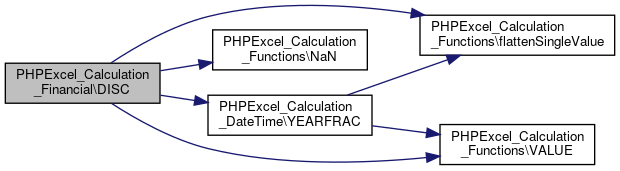

|

static |

Definition at line 1036 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

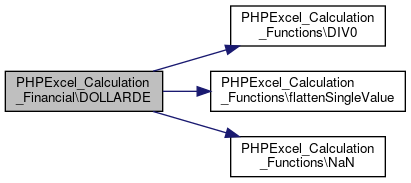

Here is the call graph for this function:◆ DOLLARDE()

|

static |

Definition at line 1079 of file Financial.php.

References PHPExcel_Calculation_Functions\DIV0(), PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

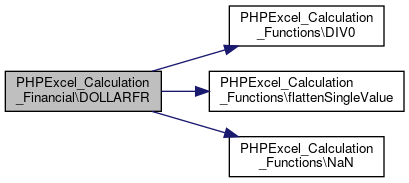

Here is the call graph for this function:◆ DOLLARFR()

|

static |

Definition at line 1115 of file Financial.php.

References PHPExcel_Calculation_Functions\DIV0(), PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

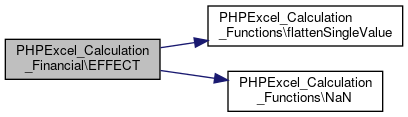

Here is the call graph for this function:◆ EFFECT()

|

static |

Definition at line 1150 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

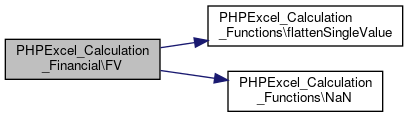

Here is the call graph for this function:◆ FV()

|

static |

Definition at line 1185 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

Here is the call graph for this function:◆ FVSCHEDULE()

|

static |

FVSCHEDULE.

Returns the future value of an initial principal after applying a series of compound interest rates. Use FVSCHEDULE to calculate the future value of an investment with a variable or adjustable rate.

Excel Function: FVSCHEDULE(principal,schedule)

- Parameters

-

float $principal The present value. float[] $schedule An array of interest rates to apply.

- Returns

- float

Definition at line 1219 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenArray(), and PHPExcel_Calculation_Functions\flattenSingleValue().

Here is the call graph for this function:

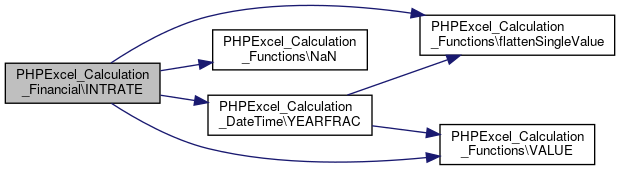

Here is the call graph for this function:◆ INTRATE()

|

static |

INTRATE.

Returns the interest rate for a fully invested security.

Excel Function: INTRATE(settlement,maturity,investment,redemption[,basis])

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. integer $investment The amount invested in the security. integer $redemption The amount to be received at maturity. integer $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 1253 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

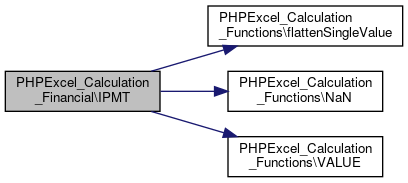

Here is the call graph for this function:◆ IPMT()

|

static |

IPMT.

Returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

Excel Function: IPMT(rate,per,nper,pv[,fv][,type])

- Parameters

-

float $rate Interest rate per period int $per Period for which we want to find the interest int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float

Definition at line 1296 of file Financial.php.

References _interestAndPrincipal(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Referenced by CUMIPMT().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

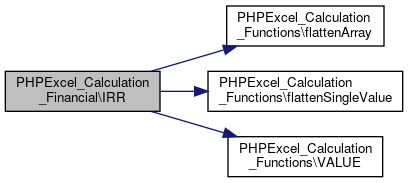

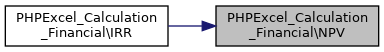

Here is the caller graph for this function:◆ IRR()

|

static |

IRR.

Returns the internal rate of return for a series of cash flows represented by the numbers in values. These cash flows do not have to be even, as they would be for an annuity. However, the cash flows must occur at regular intervals, such as monthly or annually. The internal rate of return is the interest rate received for an investment consisting of payments (negative values) and income (positive values) that occur at regular periods.

Excel Function: IRR(values[,guess])

- Parameters

-

float[] $values An array or a reference to cells that contain numbers for which you want to calculate the internal rate of return. Values must contain at least one positive value and one negative value to calculate the internal rate of return. float $guess A number that you guess is close to the result of IRR

- Returns

- float

Definition at line 1336 of file Financial.php.

References FINANCIAL_MAX_ITERATIONS, FINANCIAL_PRECISION, PHPExcel_Calculation_Functions\flattenArray(), PHPExcel_Calculation_Functions\flattenSingleValue(), NPV(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

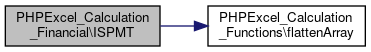

Here is the call graph for this function:◆ ISPMT()

|

static |

ISPMT.

Returns the interest payment for an investment based on an interest rate and a constant payment schedule.

Excel Function: =ISPMT(interest_rate, period, number_payments, PV)

interest_rate is the interest rate for the investment

period is the period to calculate the interest rate. It must be betweeen 1 and number_payments.

number_payments is the number of payments for the annuity

PV is the loan amount or present value of the payments

Definition at line 1394 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenArray().

Here is the call graph for this function:

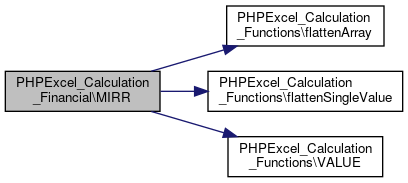

Here is the call graph for this function:◆ MIRR()

|

static |

MIRR.

Returns the modified internal rate of return for a series of periodic cash flows. MIRR considers both the cost of the investment and the interest received on reinvestment of cash.

Excel Function: MIRR(values,finance_rate, reinvestment_rate)

- Parameters

-

float[] $values An array or a reference to cells that contain a series of payments and income occurring at regular intervals. Payments are negative value, income is positive values. float $finance_rate The interest rate you pay on the money used in the cash flows float $reinvestment_rate The interest rate you receive on the cash flows as you reinvest them

- Returns

- float

Definition at line 1435 of file Financial.php.

References $n, PHPExcel_Calculation_Functions\flattenArray(), PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

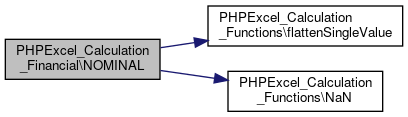

Here is the call graph for this function:◆ NOMINAL()

|

static |

NOMINAL.

Returns the nominal interest rate given the effective rate and the number of compounding payments per year.

- Parameters

-

float $effect_rate Effective interest rate int $npery Number of compounding payments per year

- Returns

- float

Definition at line 1474 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

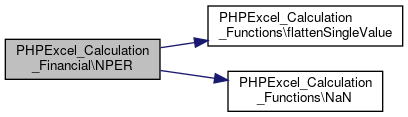

Here is the call graph for this function:◆ NPER()

|

static |

NPER.

Returns the number of periods for a cash flow with constant periodic payments (annuities), and interest rate.

- Parameters

-

float $rate Interest rate per period int $pmt Periodic payment (annuity) float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float

Definition at line 1500 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

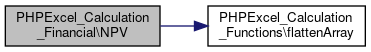

Here is the call graph for this function:◆ NPV()

|

static |

NPV.

Returns the Net Present Value of a cash flow series given a discount rate.

- Returns

- float

Definition at line 1533 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenArray().

Referenced by IRR().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

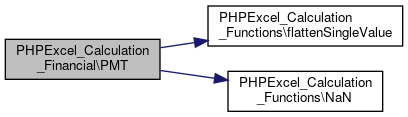

Here is the caller graph for this function:◆ PMT()

|

static |

PMT.

Returns the constant payment (annuity) for a cash flow with a constant interest rate.

- Parameters

-

float $rate Interest rate per period int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float

Definition at line 1565 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Referenced by _interestAndPrincipal().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

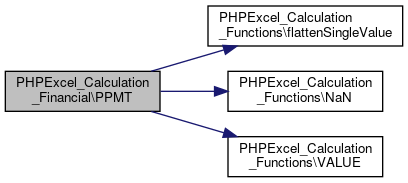

Here is the caller graph for this function:◆ PPMT()

|

static |

PPMT.

Returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

- Parameters

-

float $rate Interest rate per period int $per Period for which we want to find the interest int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float

Definition at line 1599 of file Financial.php.

References _interestAndPrincipal(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Referenced by CUMPRINC().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

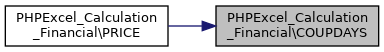

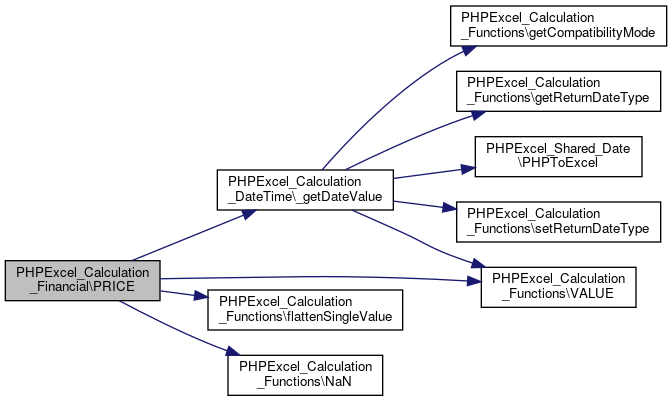

Here is the caller graph for this function:◆ PRICE()

|

static |

Definition at line 1621 of file Financial.php.

References $n, $result, PHPExcel_Calculation_DateTime\_getDateValue(), COUPDAYBS(), COUPDAYS(), COUPDAYSNC(), COUPNUM(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

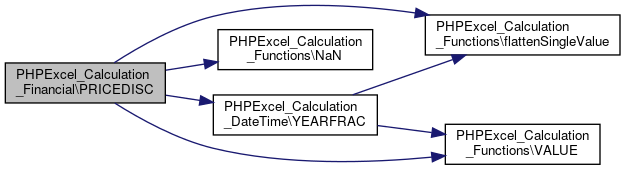

Here is the call graph for this function:◆ PRICEDISC()

|

static |

PRICEDISC.

Returns the price per $100 face value of a discounted security.

- Parameters

-

mixed settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed maturity The security's maturity date. The maturity date is the date when the security expires. int discount The security's discount rate. int redemption The security's redemption value per $100 face value. int basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 1681 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

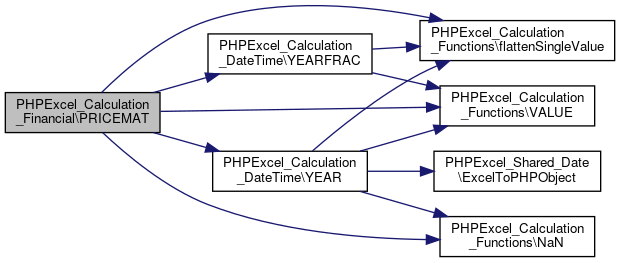

Here is the call graph for this function:◆ PRICEMAT()

|

static |

PRICEMAT.

Returns the price per $100 face value of a security that pays interest at maturity.

- Parameters

-

mixed settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed maturity The security's maturity date. The maturity date is the date when the security expires. mixed issue The security's issue date. int rate The security's interest rate at date of issue. int yield The security's annual yield. int basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 1725 of file Financial.php.

References _daysPerYear(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

Here is the call graph for this function:◆ PV()

|

static |

PV.

Returns the Present Value of a cash flow with constant payments and interest rate (annuities).

- Parameters

-

float $rate Interest rate per period int $nper Number of periods float $pmt Periodic payment (annuity) float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float

Definition at line 1781 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), and PHPExcel_Calculation_Functions\NaN().

Here is the call graph for this function:

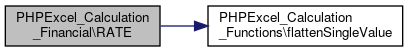

Here is the call graph for this function:◆ RATE()

|

static |

Definition at line 1832 of file Financial.php.

References $y, FINANCIAL_MAX_ITERATIONS, FINANCIAL_PRECISION, and PHPExcel_Calculation_Functions\flattenSingleValue().

Here is the call graph for this function:

Here is the call graph for this function:◆ RECEIVED()

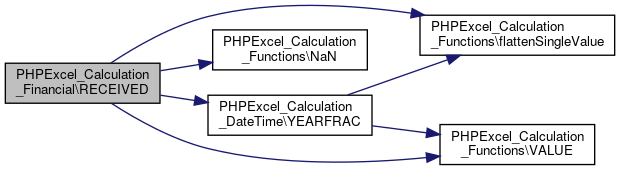

|

static |

RECEIVED.

Returns the price per $100 face value of a discounted security.

- Parameters

-

mixed settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed maturity The security's maturity date. The maturity date is the date when the security expires. int investment The amount invested in the security. int discount The security's discount rate. int basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 1894 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

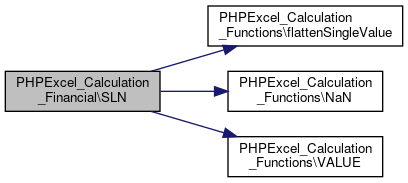

Here is the call graph for this function:◆ SLN()

|

static |

SLN.

Returns the straight-line depreciation of an asset for one period

- Parameters

-

cost Initial cost of the asset salvage Value at the end of the depreciation life Number of periods over which the asset is depreciated

- Returns

- float

Definition at line 1928 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

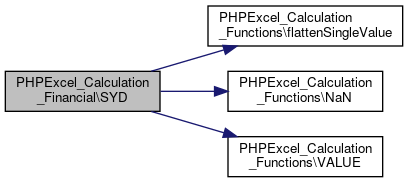

Here is the call graph for this function:◆ SYD()

|

static |

SYD.

Returns the sum-of-years' digits depreciation of an asset for a specified period.

- Parameters

-

cost Initial cost of the asset salvage Value at the end of the depreciation life Number of periods over which the asset is depreciated period Period

- Returns

- float

Definition at line 1955 of file Financial.php.

References PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Here is the call graph for this function:

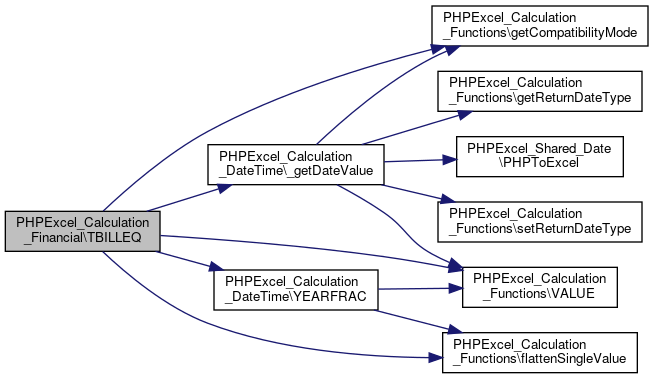

Here is the call graph for this function:◆ TBILLEQ()

|

static |

TBILLEQ.

Returns the bond-equivalent yield for a Treasury bill.

- Parameters

-

mixed settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int discount The Treasury bill's discount rate.

- Returns

- float

Definition at line 1984 of file Financial.php.

References PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\COMPATIBILITY_OPENOFFICE, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\getCompatibilityMode(), TBILLPRICE(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

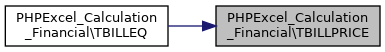

Here is the call graph for this function:◆ TBILLPRICE()

|

static |

TBILLPRICE.

Returns the yield for a Treasury bill.

- Parameters

-

mixed settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int discount The Treasury bill's discount rate.

- Returns

- float

Definition at line 2022 of file Financial.php.

References PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\COMPATIBILITY_OPENOFFICE, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\getCompatibilityMode(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Referenced by TBILLEQ().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

Here is the caller graph for this function:◆ TBILLYIELD()

|

static |

TBILLYIELD.

Returns the yield for a Treasury bill.

- Parameters

-

mixed settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int price The Treasury bill's price per $100 face value.

- Returns

- float

Definition at line 2074 of file Financial.php.

References PHPExcel_Calculation_DateTime\_getDateValue(), PHPExcel_Calculation_Functions\COMPATIBILITY_OPENOFFICE, PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\getCompatibilityMode(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

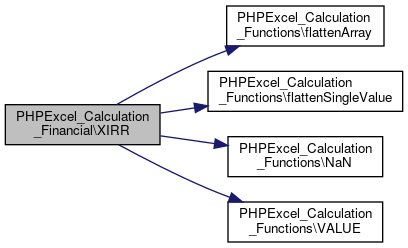

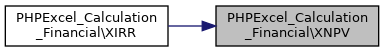

Here is the call graph for this function:◆ XIRR()

|

static |

Definition at line 2106 of file Financial.php.

References FINANCIAL_MAX_ITERATIONS, FINANCIAL_PRECISION, PHPExcel_Calculation_Functions\flattenArray(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), and XNPV().

Here is the call graph for this function:

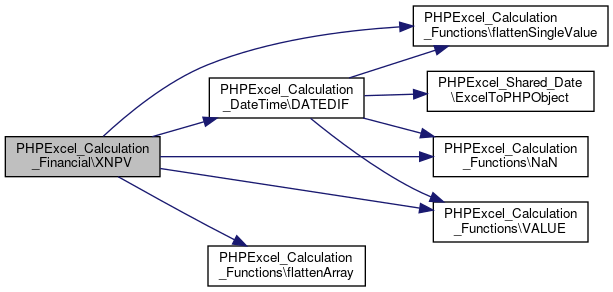

Here is the call graph for this function:◆ XNPV()

|

static |

XNPV.

Returns the net present value for a schedule of cash flows that is not necessarily periodic. To calculate the net present value for a series of cash flows that is periodic, use the NPV function.

Excel Function: =XNPV(rate,values,dates)

- Parameters

-

float $rate The discount rate to apply to the cash flows. array of float $values A series of cash flows that corresponds to a schedule of payments in dates. The first payment is optional and corresponds to a cost or payment that occurs at the beginning of the investment. If the first value is a cost or payment, it must be a negative value. All succeeding payments are discounted based on a 365-day year. The series of values must contain at least one positive value and one negative value. array of mixed $dates A schedule of payment dates that corresponds to the cash flow payments. The first payment date indicates the beginning of the schedule of payments. All other dates must be later than this date, but they may occur in any order.

- Returns

- float

Definition at line 2162 of file Financial.php.

References PHPExcel_Calculation_DateTime\DATEDIF(), PHPExcel_Calculation_Functions\flattenArray(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), and PHPExcel_Calculation_Functions\VALUE().

Referenced by XIRR().

Here is the call graph for this function:

Here is the call graph for this function: Here is the caller graph for this function:

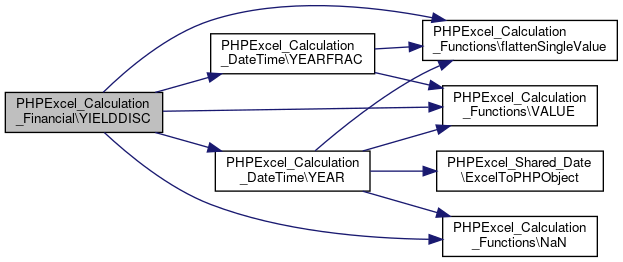

Here is the caller graph for this function:◆ YIELDDISC()

|

static |

YIELDDISC.

Returns the annual yield of a security that pays interest at maturity.

- Parameters

-

mixed settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed maturity The security's maturity date. The maturity date is the date when the security expires. int price The security's price per $100 face value. int redemption The security's redemption value per $100 face value. int basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 2200 of file Financial.php.

References _daysPerYear(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

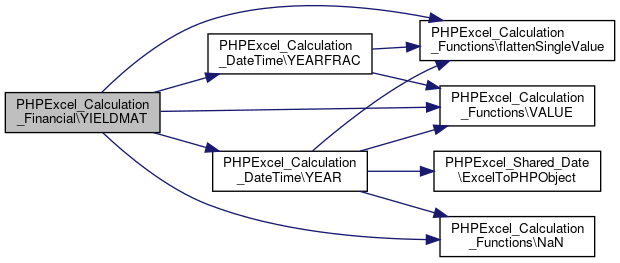

Here is the call graph for this function:◆ YIELDMAT()

|

static |

YIELDMAT.

Returns the annual yield of a security that pays interest at maturity.

- Parameters

-

mixed settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed maturity The security's maturity date. The maturity date is the date when the security expires. mixed issue The security's issue date. int rate The security's interest rate at date of issue. int price The security's price per $100 face value. int basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float

Definition at line 2249 of file Financial.php.

References _daysPerYear(), PHPExcel_Calculation_Functions\flattenSingleValue(), PHPExcel_Calculation_Functions\NaN(), PHPExcel_Calculation_Functions\VALUE(), PHPExcel_Calculation_DateTime\YEAR(), and PHPExcel_Calculation_DateTime\YEARFRAC().

Here is the call graph for this function:

Here is the call graph for this function:The documentation for this class was generated from the following file:

- libs/composer/vendor/phpoffice/phpexcel/Classes/PHPExcel/Calculation/Financial.php