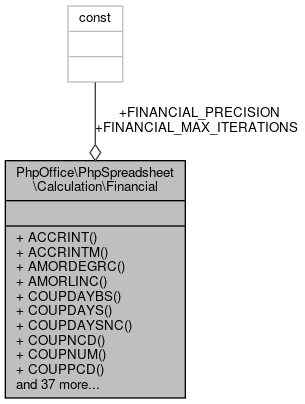

Collaboration diagram for PhpOffice\PhpSpreadsheet\Calculation\Financial:

Collaboration diagram for PhpOffice\PhpSpreadsheet\Calculation\Financial:Static Public Member Functions | |

| static | ACCRINT ( $issue, $firstInterest, $settlement, $rate, $parValue=1000, $frequency=1, $basis=0, $calcMethod=true) |

| ACCRINT. More... | |

| static | ACCRINTM ($issue, $settlement, $rate, $parValue=1000, $basis=0) |

| ACCRINTM. More... | |

| static | AMORDEGRC ($cost, $purchased, $firstPeriod, $salvage, $period, $rate, $basis=0) |

| AMORDEGRC. More... | |

| static | AMORLINC ($cost, $purchased, $firstPeriod, $salvage, $period, $rate, $basis=0) |

| AMORLINC. More... | |

| static | COUPDAYBS ($settlement, $maturity, $frequency, $basis=0) |

| COUPDAYBS. More... | |

| static | COUPDAYS ($settlement, $maturity, $frequency, $basis=0) |

| COUPDAYS. More... | |

| static | COUPDAYSNC ($settlement, $maturity, $frequency, $basis=0) |

| COUPDAYSNC. More... | |

| static | COUPNCD ($settlement, $maturity, $frequency, $basis=0) |

| COUPNCD. More... | |

| static | COUPNUM ($settlement, $maturity, $frequency, $basis=0) |

| COUPNUM. More... | |

| static | COUPPCD ($settlement, $maturity, $frequency, $basis=0) |

| COUPPCD. More... | |

| static | CUMIPMT ($rate, $nper, $pv, $start, $end, $type=0) |

| CUMIPMT. More... | |

| static | CUMPRINC ($rate, $nper, $pv, $start, $end, $type=0) |

| CUMPRINC. More... | |

| static | DB ($cost, $salvage, $life, $period, $month=12) |

| DB. More... | |

| static | DDB ($cost, $salvage, $life, $period, $factor=2.0) |

| DDB. More... | |

| static | DISC ($settlement, $maturity, $price, $redemption, $basis=0) |

| DISC. More... | |

| static | DOLLARDE ($fractional_dollar=null, $fraction=0) |

| DOLLARDE. More... | |

| static | DOLLARFR ($decimal_dollar=null, $fraction=0) |

| DOLLARFR. More... | |

| static | EFFECT ($nominalRate=0, $periodsPerYear=0) |

| EFFECT. More... | |

| static | FV ($rate=0, $nper=0, $pmt=0, $pv=0, $type=0) |

| FV. More... | |

| static | FVSCHEDULE ($principal, $schedule) |

| FVSCHEDULE. More... | |

| static | INTRATE ($settlement, $maturity, $investment, $redemption, $basis=0) |

| INTRATE. More... | |

| static | IPMT ($rate, $per, $nper, $pv, $fv=0, $type=0) |

| IPMT. More... | |

| static | IRR ($values, $guess=0.1) |

| IRR. More... | |

| static | ISPMT (... $args) |

| ISPMT. More... | |

| static | MIRR ($values, $finance_rate, $reinvestment_rate) |

| MIRR. More... | |

| static | NOMINAL ($effectiveRate=0, $periodsPerYear=0) |

| NOMINAL. More... | |

| static | NPER ($rate=0, $pmt=0, $pv=0, $fv=0, $type=0) |

| NPER. More... | |

| static | NPV (... $args) |

| NPV. More... | |

| static | PDURATION ($rate=0, $pv=0, $fv=0) |

| PDURATION. More... | |

| static | PMT ($rate=0, $nper=0, $pv=0, $fv=0, $type=0) |

| PMT. More... | |

| static | PPMT ($rate, $per, $nper, $pv, $fv=0, $type=0) |

| PPMT. More... | |

| static | PRICE ($settlement, $maturity, $rate, $yield, $redemption, $frequency, $basis=0) |

| PRICE. More... | |

| static | PRICEDISC ($settlement, $maturity, $discount, $redemption, $basis=0) |

| PRICEDISC. More... | |

| static | PRICEMAT ($settlement, $maturity, $issue, $rate, $yield, $basis=0) |

| PRICEMAT. More... | |

| static | PV ($rate=0, $nper=0, $pmt=0, $fv=0, $type=0) |

| PV. More... | |

| static | RATE ($nper, $pmt, $pv, $fv=0.0, $type=0, $guess=0.1) |

| RATE. More... | |

| static | RECEIVED ($settlement, $maturity, $investment, $discount, $basis=0) |

| RECEIVED. More... | |

| static | RRI ($nper=0, $pv=0, $fv=0) |

| RRI. More... | |

| static | SLN ($cost, $salvage, $life) |

| SLN. More... | |

| static | SYD ($cost, $salvage, $life, $period) |

| SYD. More... | |

| static | TBILLEQ ($settlement, $maturity, $discount) |

| TBILLEQ. More... | |

| static | TBILLPRICE ($settlement, $maturity, $discount) |

| TBILLPRICE. More... | |

| static | TBILLYIELD ($settlement, $maturity, $price) |

| TBILLYIELD. More... | |

| static | XIRR ($values, $dates, $guess=0.1) |

| XIRR. More... | |

| static | XNPV ($rate, $values, $dates) |

| XNPV. More... | |

| static | YIELDDISC ($settlement, $maturity, $price, $redemption, $basis=0) |

| YIELDDISC. More... | |

| static | YIELDMAT ($settlement, $maturity, $issue, $rate, $price, $basis=0) |

| YIELDMAT. More... | |

Data Fields | |

| const | FINANCIAL_MAX_ITERATIONS = 128 |

| const | FINANCIAL_PRECISION = 1.0e-08 |

Detailed Description

- Deprecated:

- 1.18.0

Definition at line 16 of file Financial.php.

Member Function Documentation

◆ ACCRINT()

|

static |

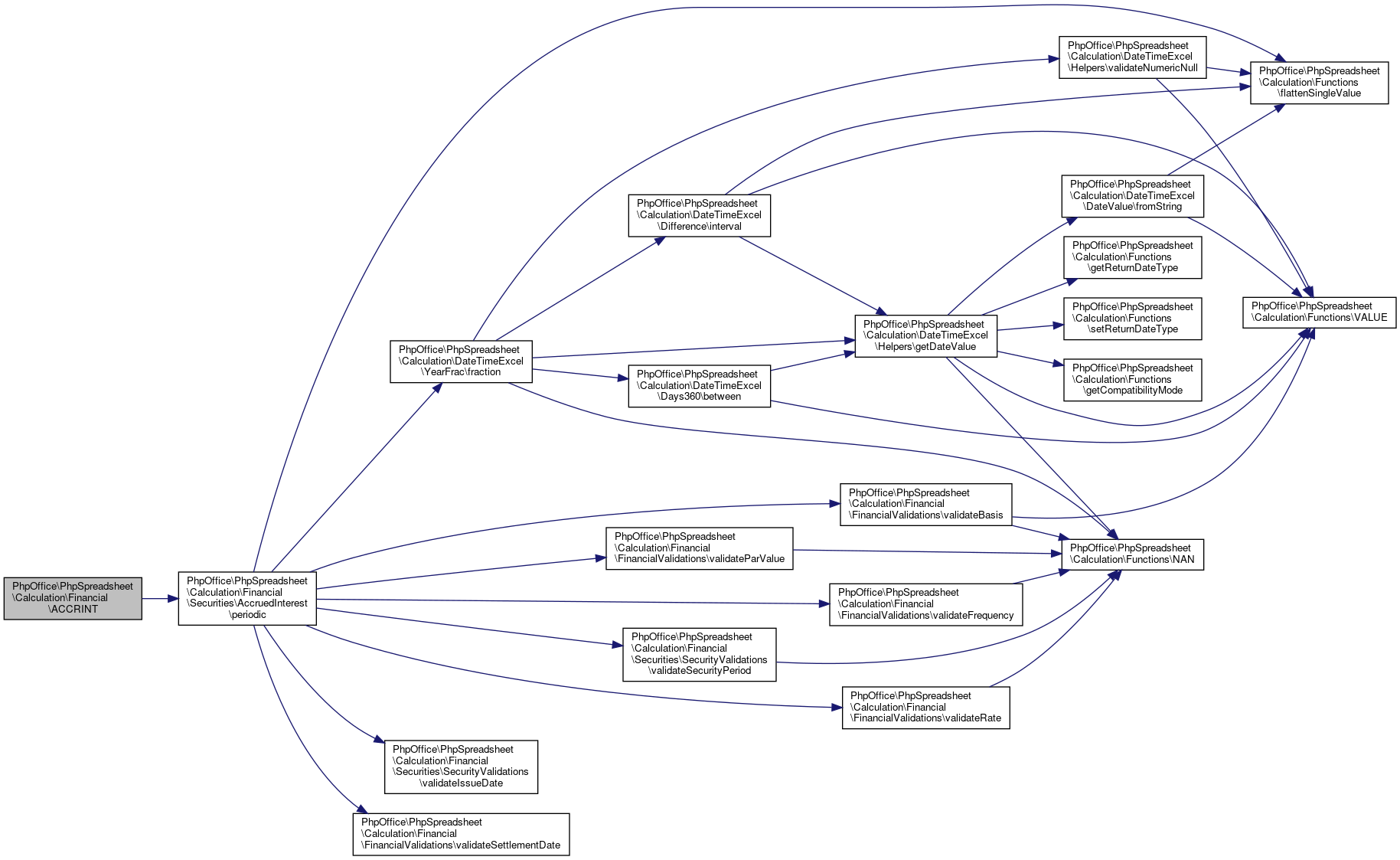

ACCRINT.

Returns the accrued interest for a security that pays periodic interest.

Excel Function: ACCRINT(issue,firstinterest,settlement,rate,par,frequency[,basis][,calc_method])

@Deprecated 1.18.0

- See also

- Financial\Securities\AccruedInterest::periodic() Use the periodic() method in the Financial\Securities\AccruedInterest class instead

- Parameters

-

mixed $issue the security's issue date mixed $firstInterest the security's first interest date mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $rate the security's annual coupon rate mixed $parValue The security's par value. If you omit par, ACCRINT uses $1,000. mixed $frequency The number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly mixed $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360 mixed $calcMethod If true, use Issue to Settlement If false, use FirstInterest to Settlement

- Returns

- float|string Result, or a string containing an error

Definition at line 60 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\AccruedInterest\periodic().

Here is the call graph for this function:

Here is the call graph for this function:◆ ACCRINTM()

|

static |

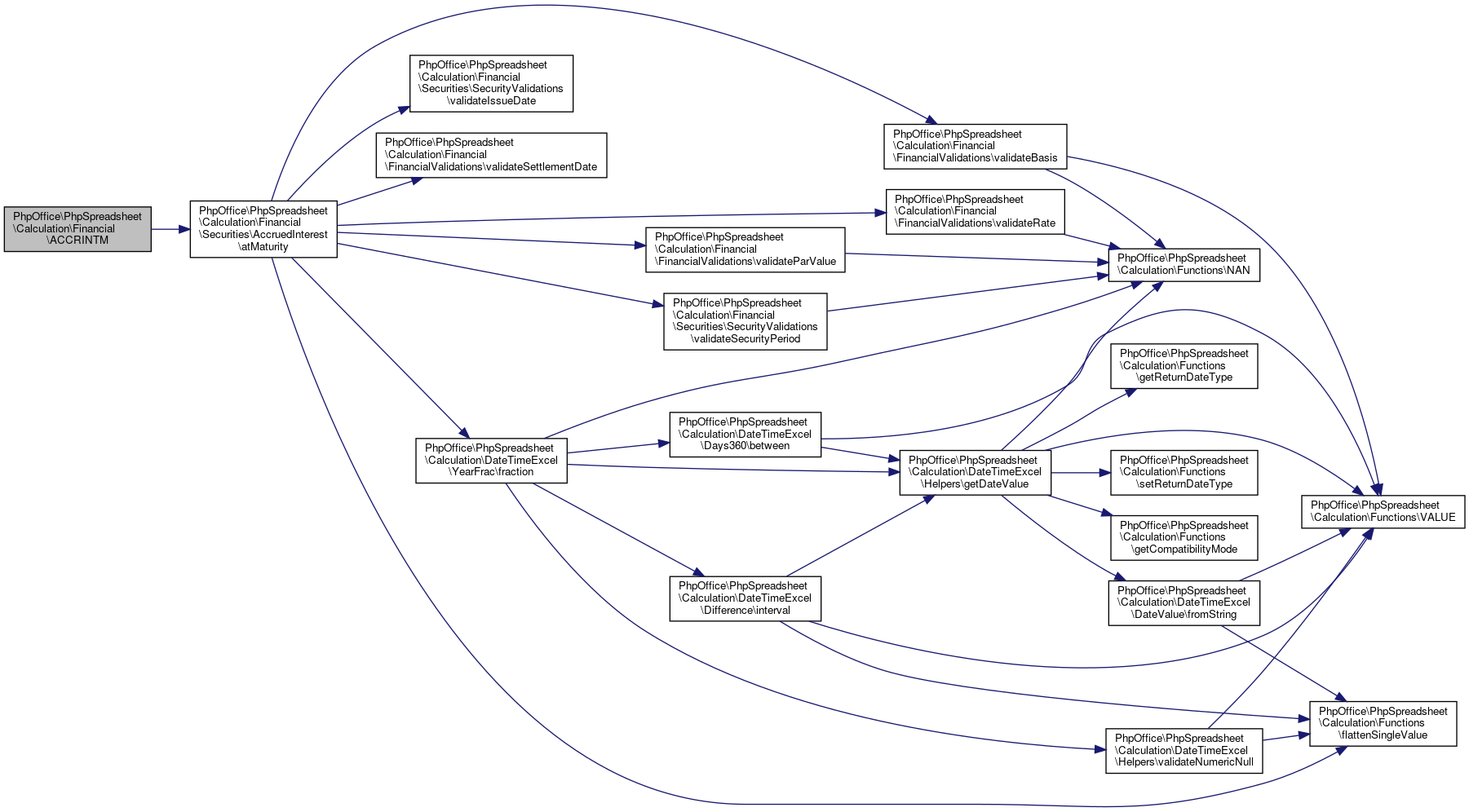

ACCRINTM.

Returns the accrued interest for a security that pays interest at maturity.

Excel Function: ACCRINTM(issue,settlement,rate[,par[,basis]])

@Deprecated 1.18.0

- See also

- Financial\Securities\AccruedInterest::atMaturity() Use the atMaturity() method in the Financial\Securities\AccruedInterest class instead

- Parameters

-

mixed $issue The security's issue date mixed $settlement The security's settlement (or maturity) date mixed $rate The security's annual coupon rate mixed $parValue The security's par value. If you omit par, ACCRINT uses $1,000. mixed $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 109 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\AccruedInterest\atMaturity().

Here is the call graph for this function:

Here is the call graph for this function:◆ AMORDEGRC()

|

static |

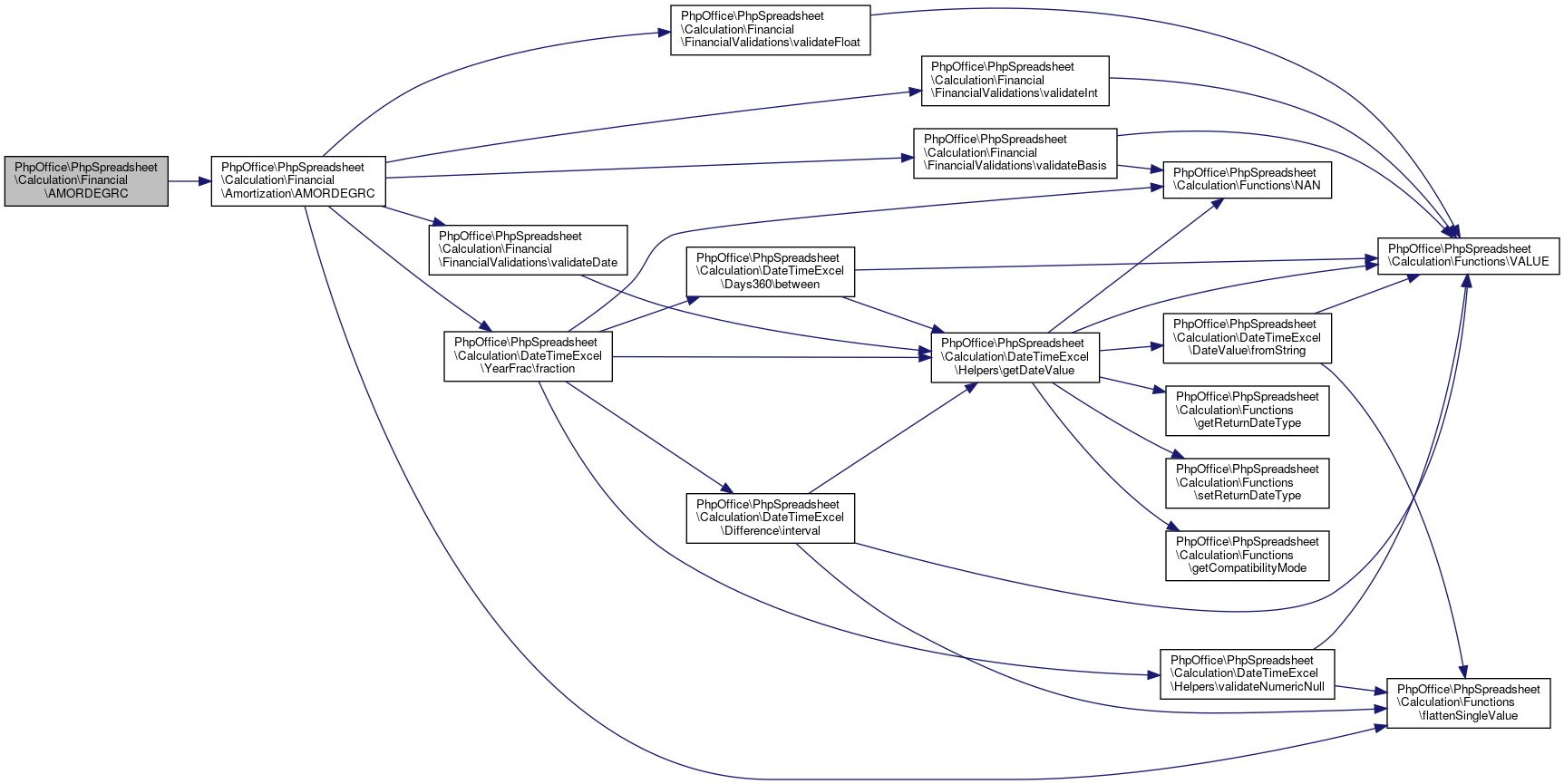

AMORDEGRC.

Returns the depreciation for each accounting period. This function is provided for the French accounting system. If an asset is purchased in the middle of the accounting period, the prorated depreciation is taken into account. The function is similar to AMORLINC, except that a depreciation coefficient is applied in the calculation depending on the life of the assets. This function will return the depreciation until the last period of the life of the assets or until the cumulated value of depreciation is greater than the cost of the assets minus the salvage value.

Excel Function: AMORDEGRC(cost,purchased,firstPeriod,salvage,period,rate[,basis])

@Deprecated 1.18.0

- See also

- Financial\Amortization::AMORDEGRC() Use the AMORDEGRC() method in the Financial\Amortization class instead

- Parameters

-

float $cost The cost of the asset mixed $purchased Date of the purchase of the asset mixed $firstPeriod Date of the end of the first period mixed $salvage The salvage value at the end of the life of the asset float $period The period float $rate Rate of depreciation int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string (string containing the error type if there is an error)

Definition at line 149 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Amortization\AMORDEGRC().

Here is the call graph for this function:

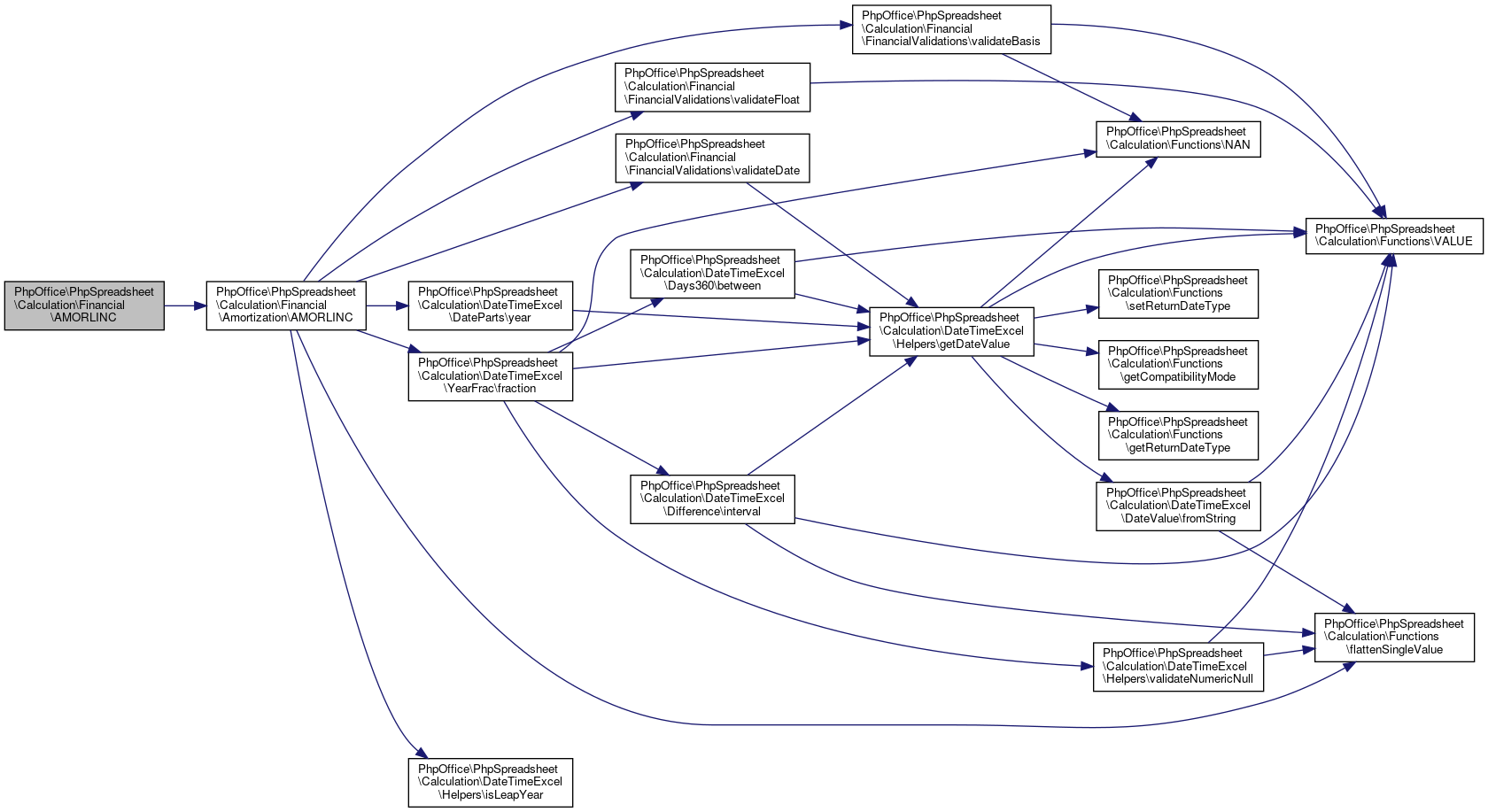

Here is the call graph for this function:◆ AMORLINC()

|

static |

AMORLINC.

Returns the depreciation for each accounting period. This function is provided for the French accounting system. If an asset is purchased in the middle of the accounting period, the prorated depreciation is taken into account.

Excel Function: AMORLINC(cost,purchased,firstPeriod,salvage,period,rate[,basis])

@Deprecated 1.18.0

- See also

- Financial\Amortization::AMORLINC() Use the AMORLINC() method in the Financial\Amortization class instead

- Parameters

-

float $cost The cost of the asset mixed $purchased Date of the purchase of the asset mixed $firstPeriod Date of the end of the first period mixed $salvage The salvage value at the end of the life of the asset float $period The period float $rate Rate of depreciation int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string (string containing the error type if there is an error)

Definition at line 184 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Amortization\AMORLINC().

Here is the call graph for this function:

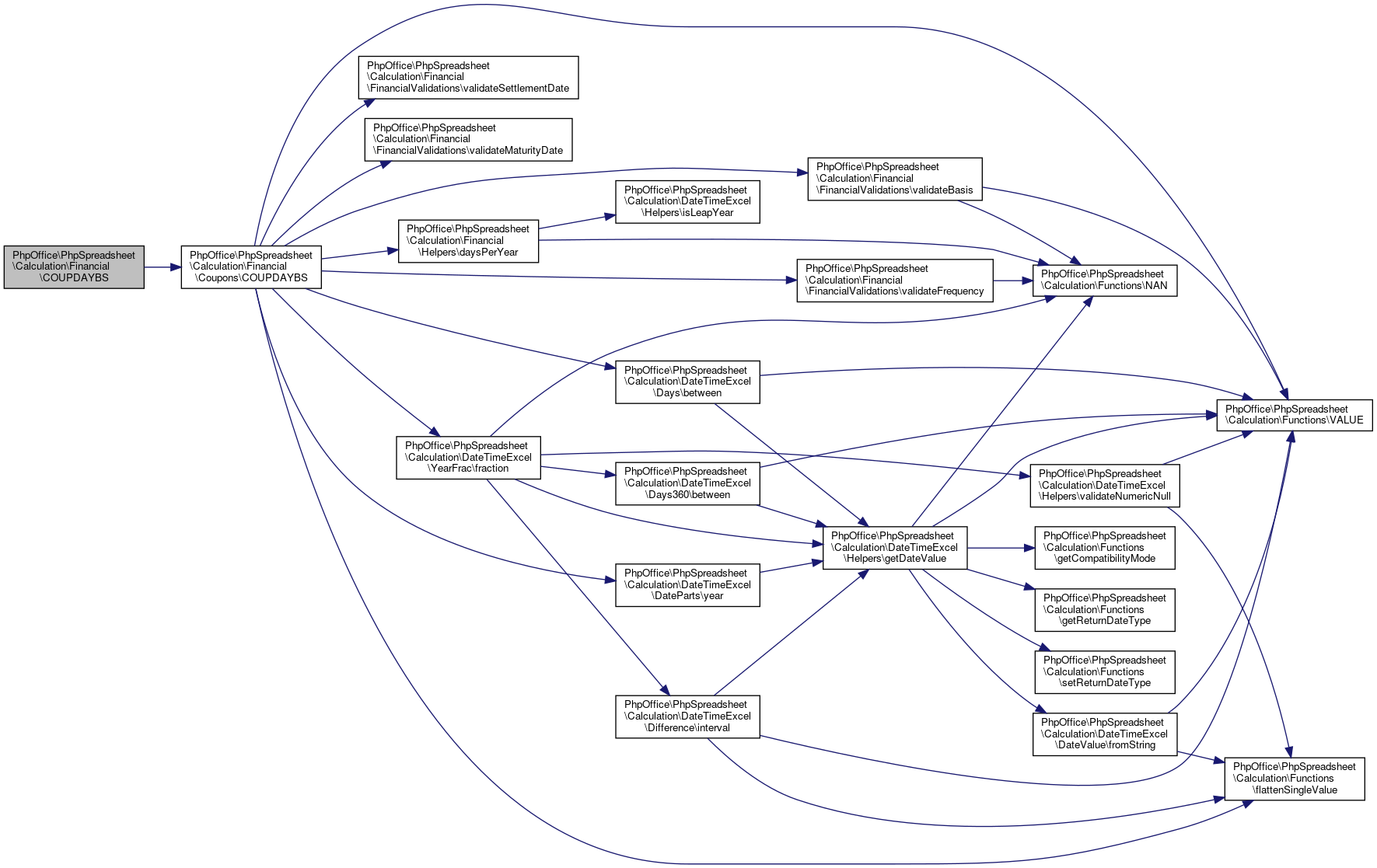

Here is the call graph for this function:◆ COUPDAYBS()

|

static |

COUPDAYBS.

Returns the number of days from the beginning of the coupon period to the settlement date.

Excel Function: COUPDAYBS(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPDAYBS() Use the COUPDAYBS() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. int $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string

Definition at line 221 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPDAYBS().

Here is the call graph for this function:

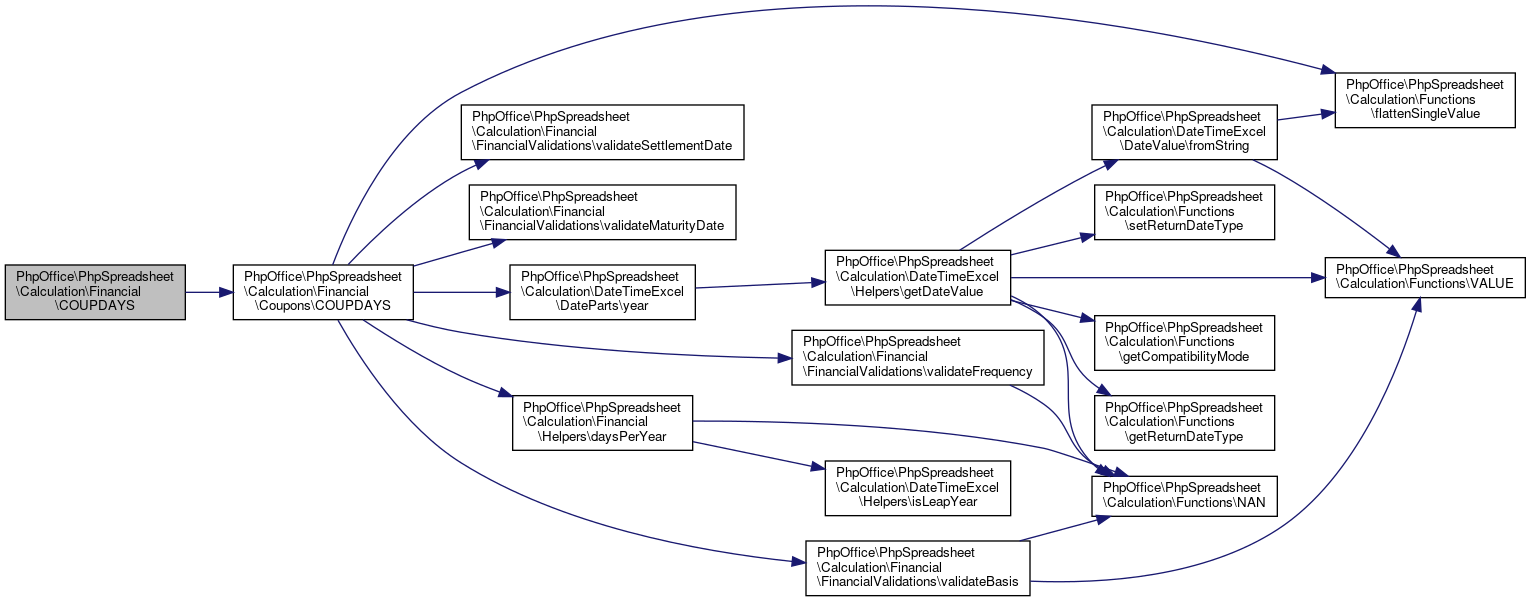

Here is the call graph for this function:◆ COUPDAYS()

|

static |

COUPDAYS.

Returns the number of days in the coupon period that contains the settlement date.

Excel Function: COUPDAYS(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPDAYS() Use the COUPDAYS() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string

Definition at line 258 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPDAYS().

Here is the call graph for this function:

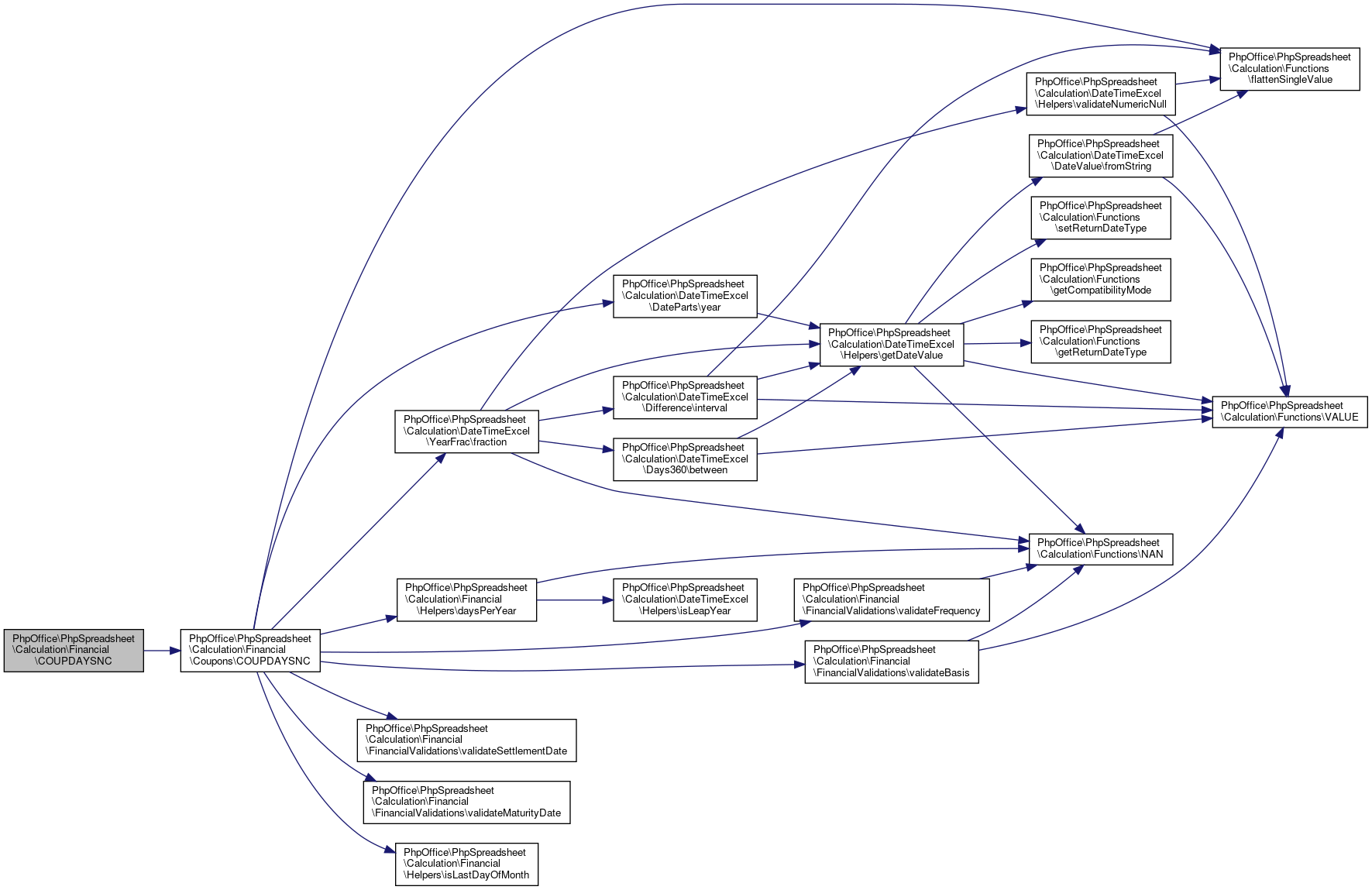

Here is the call graph for this function:◆ COUPDAYSNC()

|

static |

COUPDAYSNC.

Returns the number of days from the settlement date to the next coupon date.

Excel Function: COUPDAYSNC(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPDAYSNC() Use the COUPDAYSNC() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string

Definition at line 295 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPDAYSNC().

Here is the call graph for this function:

Here is the call graph for this function:◆ COUPNCD()

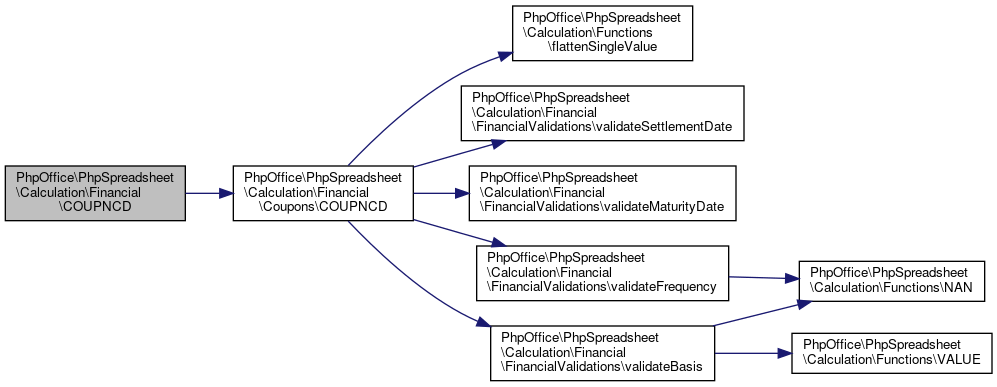

|

static |

COUPNCD.

Returns the next coupon date after the settlement date.

Excel Function: COUPNCD(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPNCD() Use the COUPNCD() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- mixed Excel date/time serial value, PHP date/time serial value or PHP date/time object, depending on the value of the ReturnDateType flag

Definition at line 333 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPNCD().

Here is the call graph for this function:

Here is the call graph for this function:◆ COUPNUM()

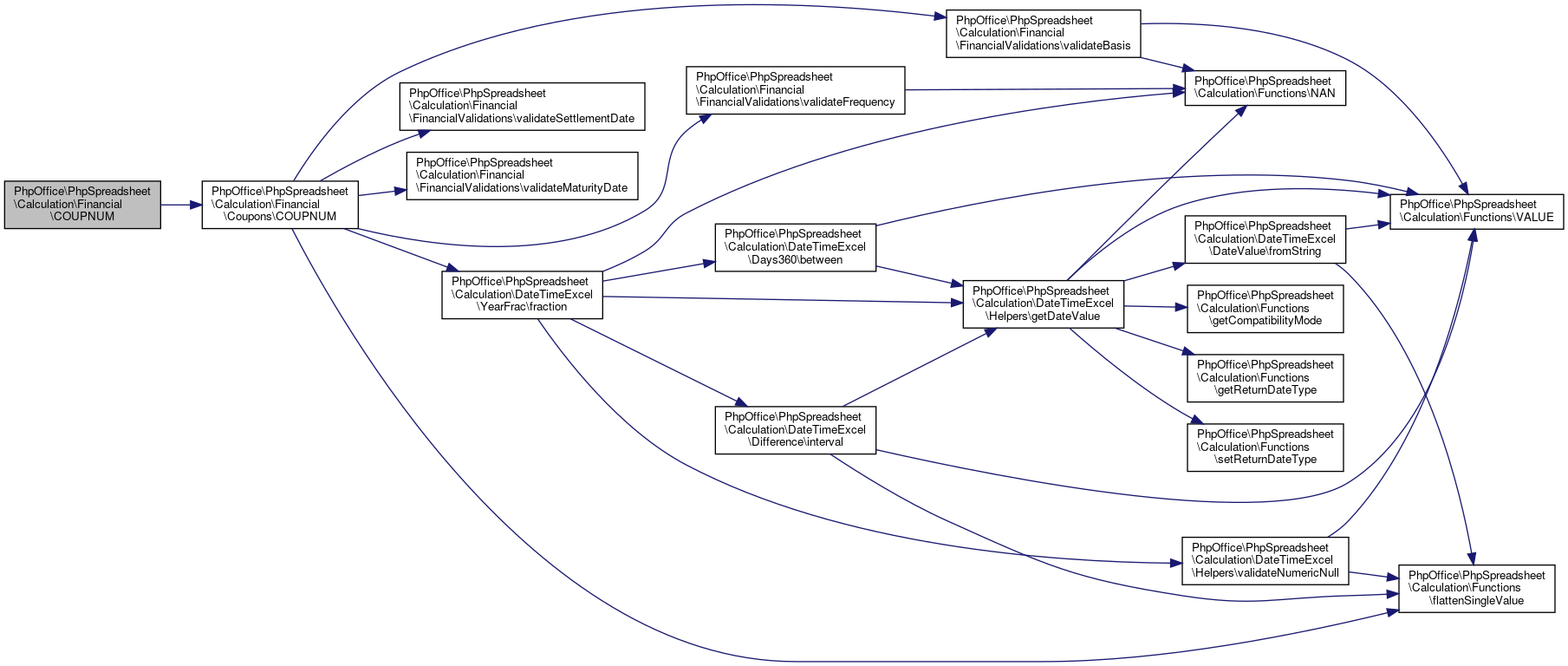

|

static |

COUPNUM.

Returns the number of coupons payable between the settlement date and maturity date, rounded up to the nearest whole coupon.

Excel Function: COUPNUM(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPNUM() Use the COUPNUM() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- int|string

Definition at line 371 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPNUM().

Here is the call graph for this function:

Here is the call graph for this function:◆ COUPPCD()

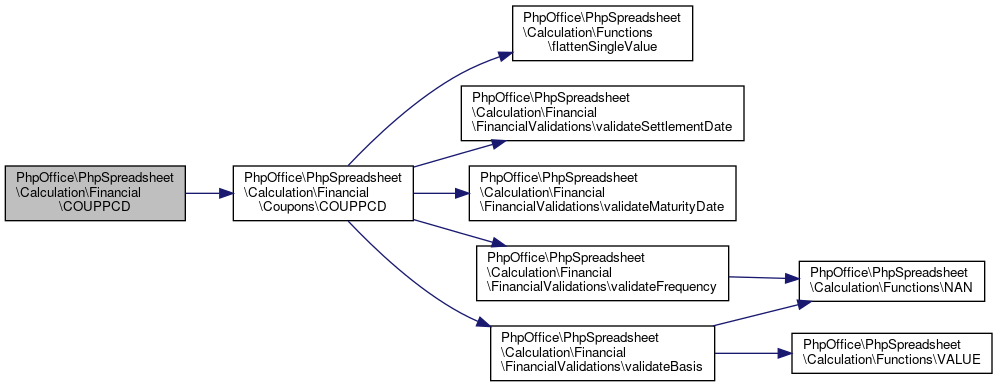

|

static |

COUPPCD.

Returns the previous coupon date before the settlement date.

Excel Function: COUPPCD(settlement,maturity,frequency[,basis])

@Deprecated 1.18.0

- See also

- Financial\Coupons::COUPPCD() Use the COUPPCD() method in the Financial\Coupons class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $frequency the number of coupon payments per year. Valid frequency values are: 1 Annual 2 Semi-Annual 4 Quarterly int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- mixed Excel date/time serial value, PHP date/time serial value or PHP date/time object, depending on the value of the ReturnDateType flag

Definition at line 409 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Coupons\COUPPCD().

Here is the call graph for this function:

Here is the call graph for this function:◆ CUMIPMT()

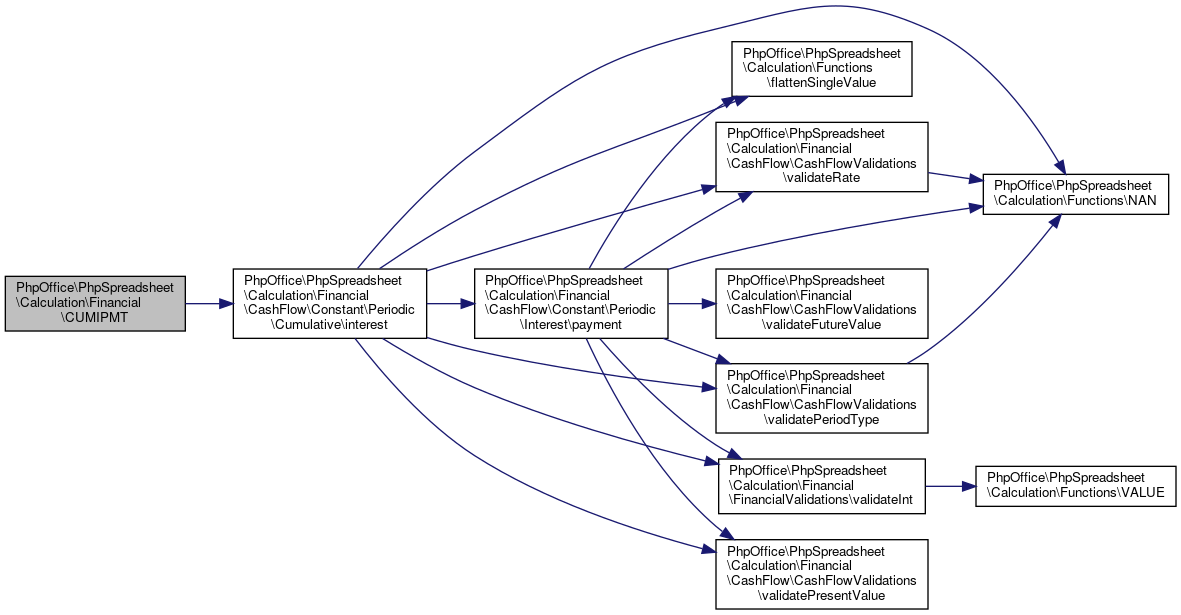

|

static |

CUMIPMT.

Returns the cumulative interest paid on a loan between the start and end periods.

Excel Function: CUMIPMT(rate,nper,pv,start,end[,type])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Cumulative::interest() Use the interest() method in the Financial\CashFlow\Constant\Periodic\Cumulative class instead

- Parameters

-

float $rate The Interest rate int $nper The total number of payment periods float $pv Present Value int $start The first period in the calculation. Payment periods are numbered beginning with 1. int $end the last period in the calculation int $type A number 0 or 1 and indicates when payments are due: 0 or omitted At the end of the period. 1 At the beginning of the period.

- Returns

- float|string

Definition at line 439 of file Financial.php.

References $end, $start, $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Cumulative\interest().

Here is the call graph for this function:

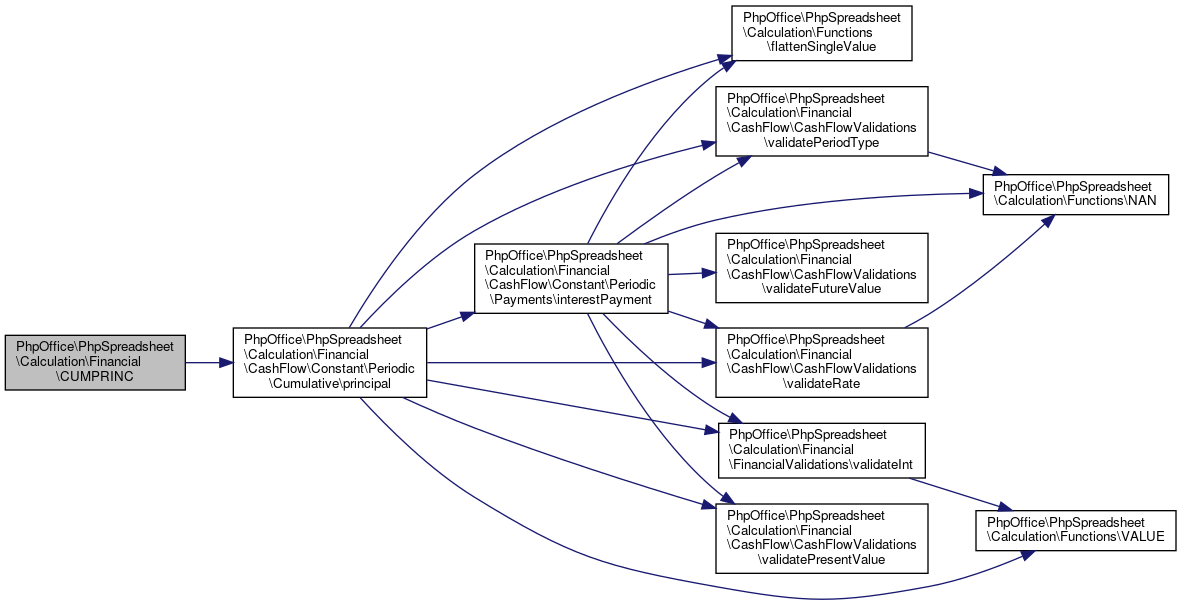

Here is the call graph for this function:◆ CUMPRINC()

|

static |

CUMPRINC.

Returns the cumulative principal paid on a loan between the start and end periods.

Excel Function: CUMPRINC(rate,nper,pv,start,end[,type])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Cumulative::principal() Use the principal() method in the Financial\CashFlow\Constant\Periodic\Cumulative class instead

- Parameters

-

float $rate The Interest rate int $nper The total number of payment periods float $pv Present Value int $start The first period in the calculation. Payment periods are numbered beginning with 1. int $end the last period in the calculation int $type A number 0 or 1 and indicates when payments are due: 0 or omitted At the end of the period. 1 At the beginning of the period.

- Returns

- float|string

Definition at line 469 of file Financial.php.

References $end, $start, $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Cumulative\principal().

Here is the call graph for this function:

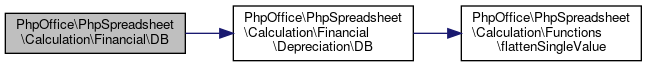

Here is the call graph for this function:◆ DB()

|

static |

DB.

Returns the depreciation of an asset for a specified period using the fixed-declining balance method. This form of depreciation is used if you want to get a higher depreciation value at the beginning of the depreciation (as opposed to linear depreciation). The depreciation value is reduced with every depreciation period by the depreciation already deducted from the initial cost.

Excel Function: DB(cost,salvage,life,period[,month])

@Deprecated 1.18.0

- See also

- Financial\Depreciation::DB() Use the DB() method in the Financial\Depreciation class instead

- Parameters

-

float $cost Initial cost of the asset float $salvage Value at the end of the depreciation. (Sometimes called the salvage value of the asset) int $life Number of periods over which the asset is depreciated. (Sometimes called the useful life of the asset) int $period The period for which you want to calculate the depreciation. Period must use the same units as life. int $month Number of months in the first year. If month is omitted, it defaults to 12.

- Returns

- float|string

Definition at line 504 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Depreciation\DB().

Here is the call graph for this function:

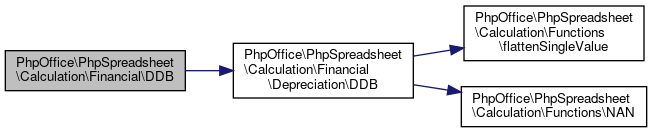

Here is the call graph for this function:◆ DDB()

|

static |

DDB.

Returns the depreciation of an asset for a specified period using the double-declining balance method or some other method you specify.

Excel Function: DDB(cost,salvage,life,period[,factor])

@Deprecated 1.18.0

- See also

- Financial\Depreciation::DDB() Use the DDB() method in the Financial\Depreciation class instead

- Parameters

-

float $cost Initial cost of the asset float $salvage Value at the end of the depreciation. (Sometimes called the salvage value of the asset) int $life Number of periods over which the asset is depreciated. (Sometimes called the useful life of the asset) int $period The period for which you want to calculate the depreciation. Period must use the same units as life. float $factor The rate at which the balance declines. If factor is omitted, it is assumed to be 2 (the double-declining balance method).

- Returns

- float|string

Definition at line 536 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Depreciation\DDB().

Here is the call graph for this function:

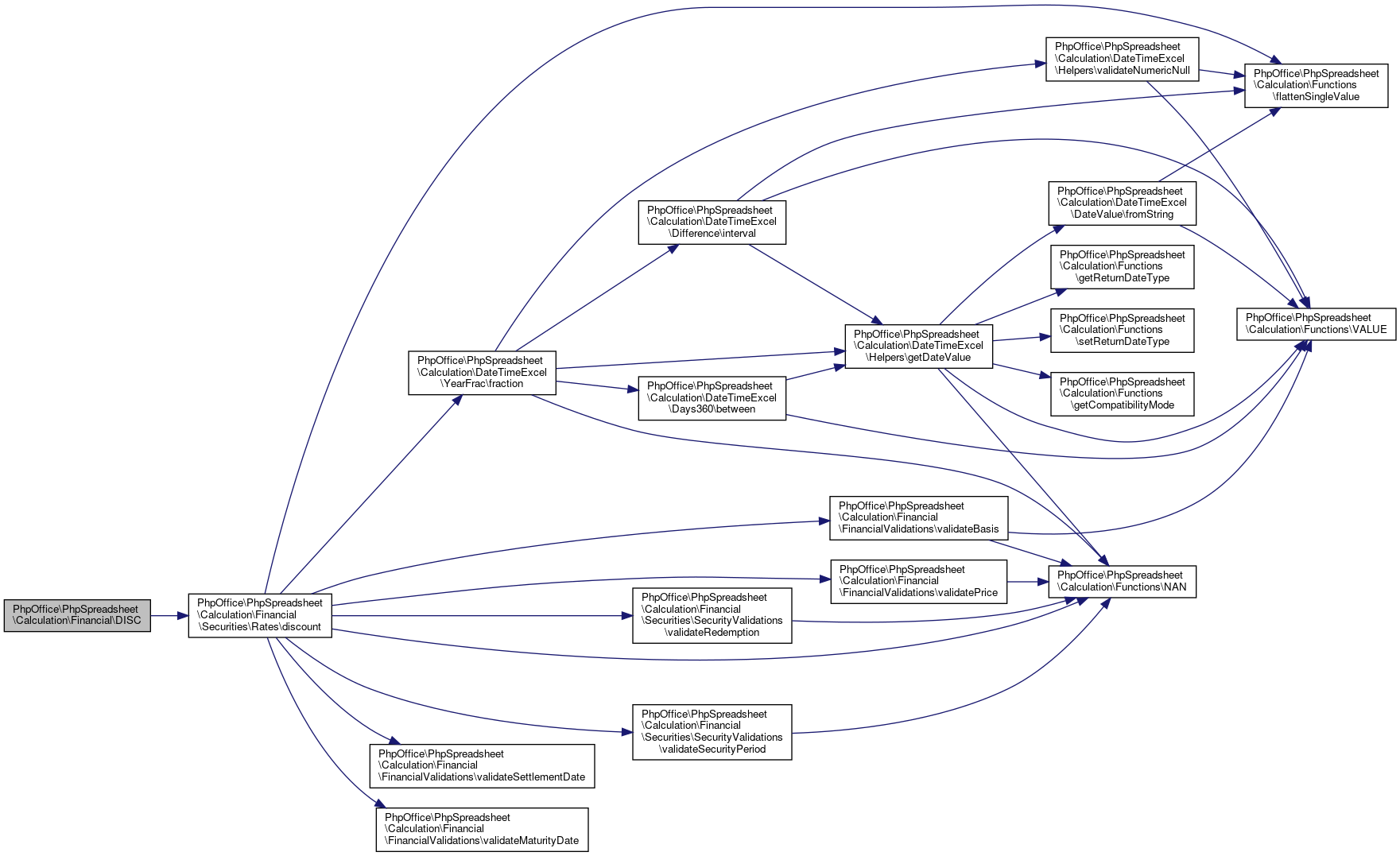

Here is the call graph for this function:◆ DISC()

|

static |

DISC.

Returns the discount rate for a security.

Excel Function: DISC(settlement,maturity,price,redemption[,basis])

@Deprecated 1.18.0

- See also

- Financial\Securities\Rates::discount() Use the discount() method in the Financial\Securities\Rates class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. int $price The security's price per $100 face value int $redemption The security's redemption value per $100 face value int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string

Definition at line 570 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Rates\discount().

Here is the call graph for this function:

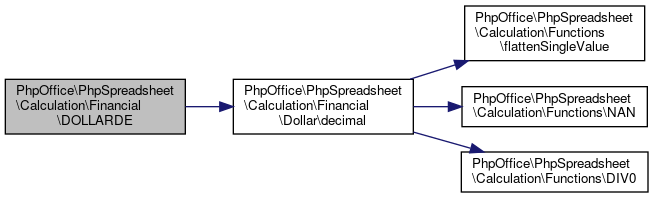

Here is the call graph for this function:◆ DOLLARDE()

|

static |

DOLLARDE.

Converts a dollar price expressed as an integer part and a fraction part into a dollar price expressed as a decimal number. Fractional dollar numbers are sometimes used for security prices.

Excel Function: DOLLARDE(fractional_dollar,fraction)

@Deprecated 1.18.0

- Parameters

-

float $fractional_dollar Fractional Dollar int $fraction Fraction

- Returns

- float|string

Definition at line 595 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Dollar\decimal().

Here is the call graph for this function:

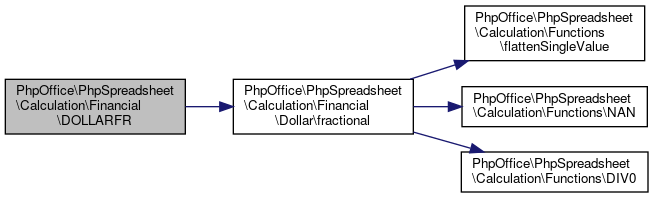

Here is the call graph for this function:◆ DOLLARFR()

|

static |

DOLLARFR.

Converts a dollar price expressed as a decimal number into a dollar price expressed as a fraction. Fractional dollar numbers are sometimes used for security prices.

Excel Function: DOLLARFR(decimal_dollar,fraction)

@Deprecated 1.18.0

- See also

- Financial\Dollar::fractional() Use the fractional() method in the Financial\Dollar class instead

- Parameters

-

float $decimal_dollar Decimal Dollar int $fraction Fraction

- Returns

- float|string

Definition at line 620 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Dollar\fractional().

Here is the call graph for this function:

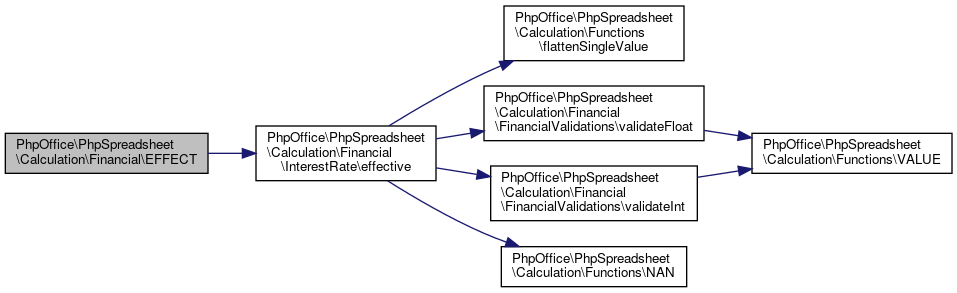

Here is the call graph for this function:◆ EFFECT()

|

static |

EFFECT.

Returns the effective interest rate given the nominal rate and the number of compounding payments per year.

Excel Function: EFFECT(nominal_rate,npery)

@Deprecated 1.18.0

- See also

- Financial\InterestRate::effective() Use the effective() method in the Financial\InterestRate class instead

- Parameters

-

float $nominalRate Nominal interest rate int $periodsPerYear Number of compounding payments per year

- Returns

- float|string

Definition at line 644 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\InterestRate\effective().

Here is the call graph for this function:

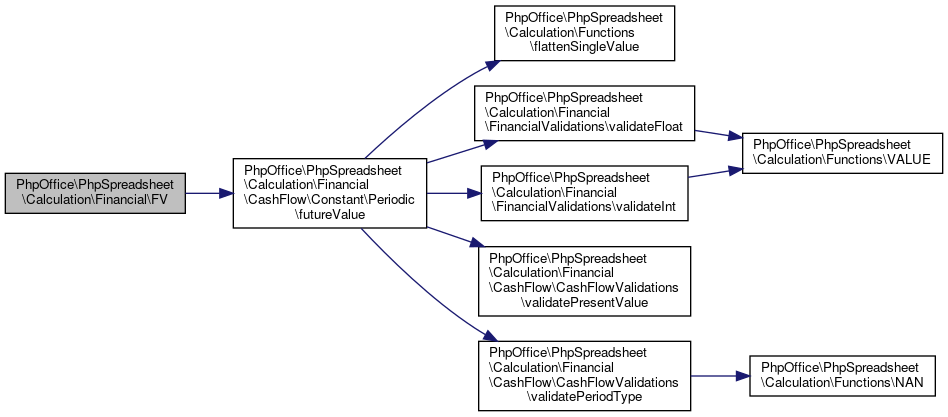

Here is the call graph for this function:◆ FV()

|

static |

FV.

Returns the Future Value of a cash flow with constant payments and interest rate (annuities).

Excel Function: FV(rate,nper,pmt[,pv[,type]])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic::futureValue() Use the futureValue() method in the Financial\CashFlow\Constant\Periodic class instead

- Parameters

-

float $rate The interest rate per period int $nper Total number of payment periods in an annuity float $pmt The payment made each period: it cannot change over the life of the annuity. Typically, pmt contains principal and interest but no other fees or taxes. float $pv present Value, or the lump-sum amount that a series of future payments is worth right now int $type A number 0 or 1 and indicates when payments are due: 0 or omitted At the end of the period. 1 At the beginning of the period.

- Returns

- float|string

Definition at line 675 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\futureValue().

Here is the call graph for this function:

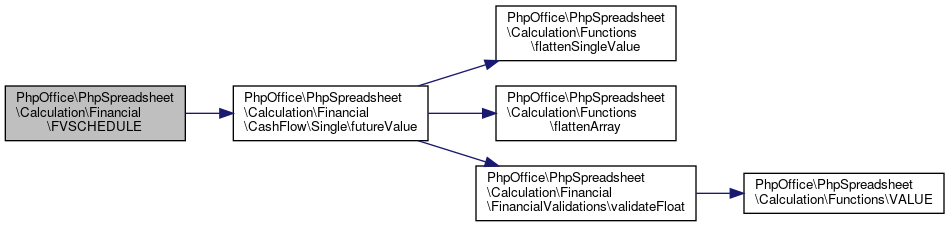

Here is the call graph for this function:◆ FVSCHEDULE()

|

static |

FVSCHEDULE.

Returns the future value of an initial principal after applying a series of compound interest rates. Use FVSCHEDULE to calculate the future value of an investment with a variable or adjustable rate.

Excel Function: FVSCHEDULE(principal,schedule)

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Single::futureValue() Use the futureValue() method in the Financial\CashFlow\Single class instead

- Parameters

-

float $principal the present value float[] $schedule an array of interest rates to apply

- Returns

- float|string

Definition at line 699 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Single\futureValue().

Here is the call graph for this function:

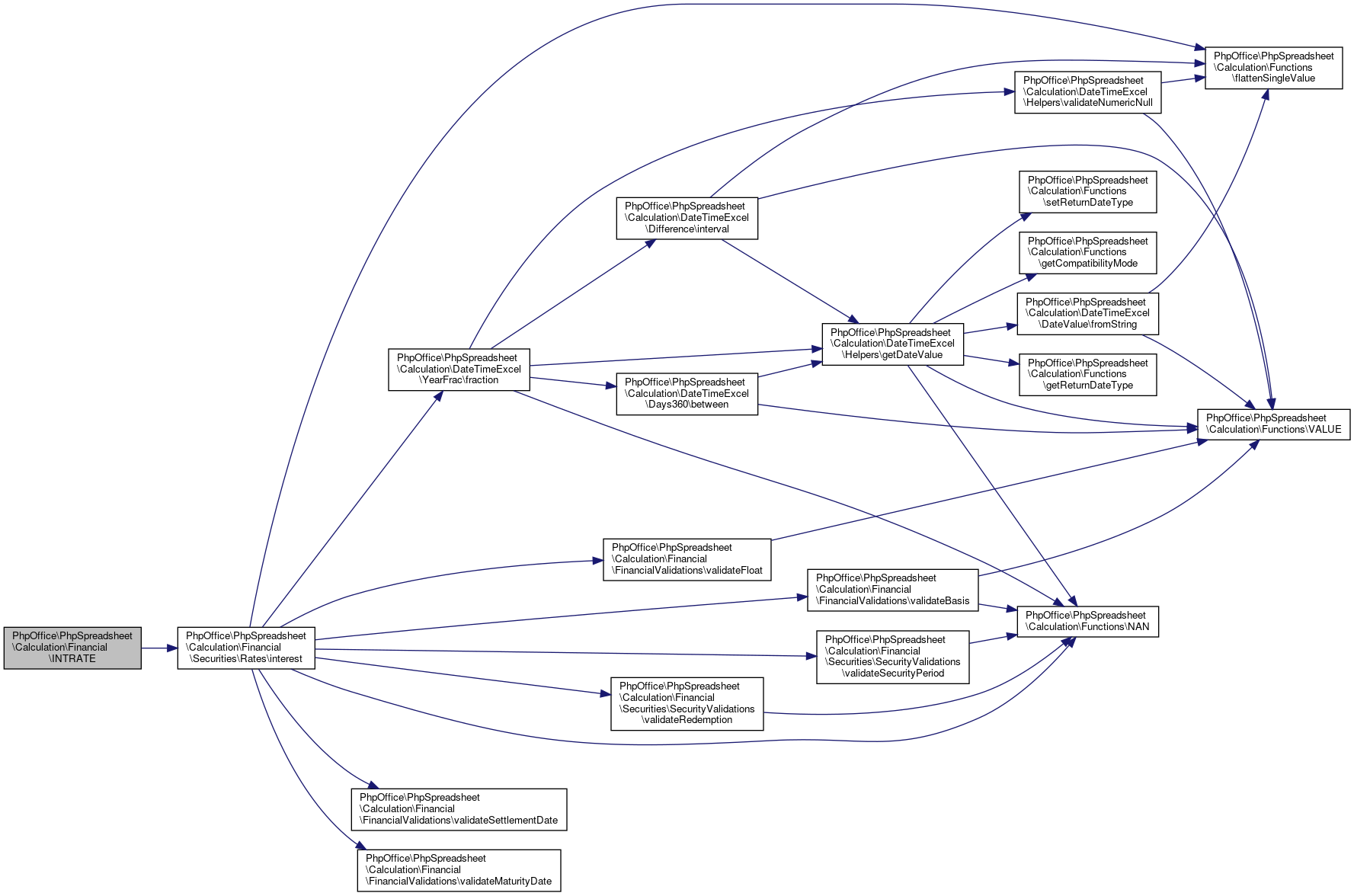

Here is the call graph for this function:◆ INTRATE()

|

static |

INTRATE.

Returns the interest rate for a fully invested security.

Excel Function: INTRATE(settlement,maturity,investment,redemption[,basis])

@Deprecated 1.18.0

- See also

- Financial\Securities\Rates::interest() Use the interest() method in the Financial\Securities\Rates class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. int $investment the amount invested in the security int $redemption the amount to be received at maturity int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string

Definition at line 733 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Rates\interest().

Here is the call graph for this function:

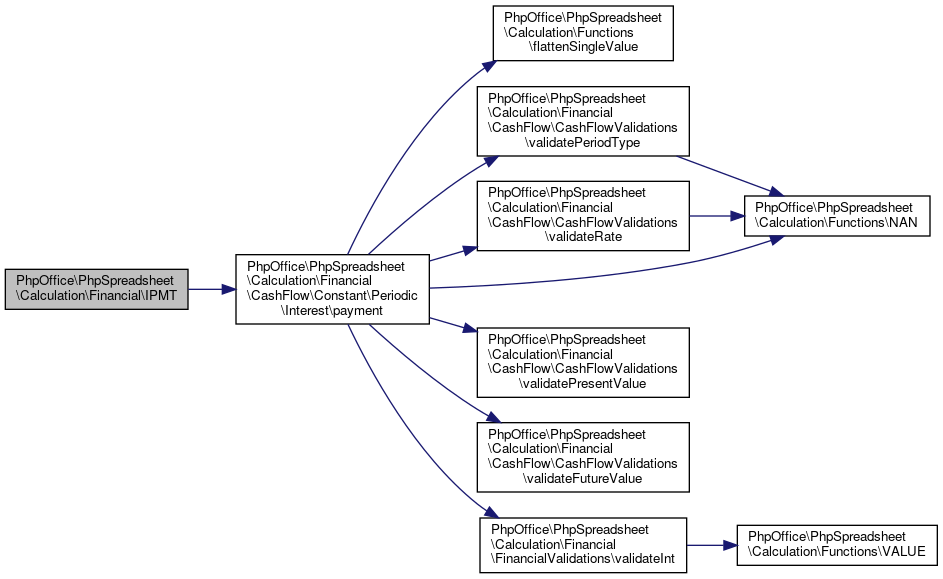

Here is the call graph for this function:◆ IPMT()

|

static |

IPMT.

Returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

Excel Function: IPMT(rate,per,nper,pv[,fv][,type])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Interest::payment() Use the payment() method in the Financial\CashFlow\Constant\Periodic class instead

- Parameters

-

float $rate Interest rate per period int $per Period for which we want to find the interest int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float|string

Definition at line 761 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Interest\payment().

Here is the call graph for this function:

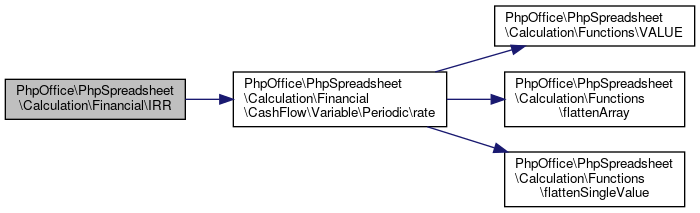

Here is the call graph for this function:◆ IRR()

|

static |

IRR.

Returns the internal rate of return for a series of cash flows represented by the numbers in values. These cash flows do not have to be even, as they would be for an annuity. However, the cash flows must occur at regular intervals, such as monthly or annually. The internal rate of return is the interest rate received for an investment consisting of payments (negative values) and income (positive values) that occur at regular periods.

Excel Function: IRR(values[,guess])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Variable\Periodic::rate() Use the rate() method in the Financial\CashFlow\Variable\Periodic class instead

- Parameters

-

mixed $values An array or a reference to cells that contain numbers for which you want to calculate the internal rate of return. Values must contain at least one positive value and one negative value to calculate the internal rate of return. mixed $guess A number that you guess is close to the result of IRR

- Returns

- float|string

Definition at line 791 of file Financial.php.

References $values, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Variable\Periodic\rate().

Here is the call graph for this function:

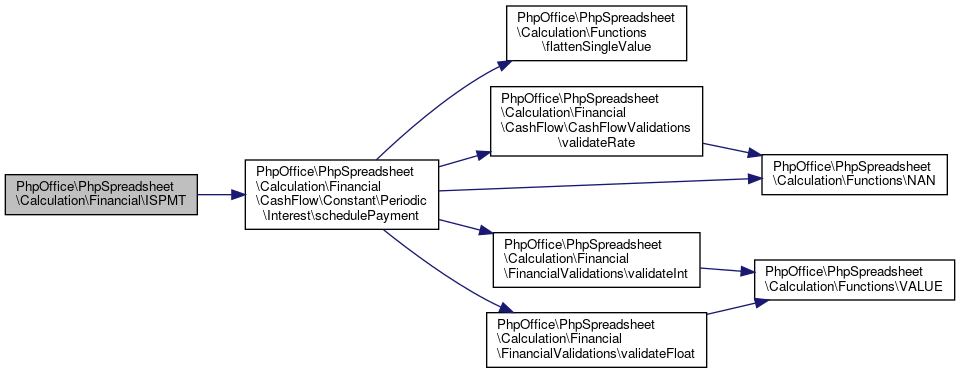

Here is the call graph for this function:◆ ISPMT()

|

static |

ISPMT.

Returns the interest payment for an investment based on an interest rate and a constant payment schedule.

Excel Function: =ISPMT(interest_rate, period, number_payments, pv)

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Interest::schedulePayment() Use the schedulePayment() method in the Financial\CashFlow\Constant\Periodic class instead

interest_rate is the interest rate for the investment

period is the period to calculate the interest rate. It must be betweeen 1 and number_payments.

number_payments is the number of payments for the annuity

pv is the loan amount or present value of the payments

Definition at line 817 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Interest\schedulePayment().

Here is the call graph for this function:

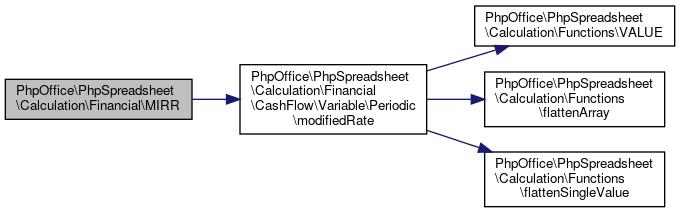

Here is the call graph for this function:◆ MIRR()

|

static |

MIRR.

Returns the modified internal rate of return for a series of periodic cash flows. MIRR considers both the cost of the investment and the interest received on reinvestment of cash.

Excel Function: MIRR(values,finance_rate, reinvestment_rate)

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Variable\Periodic::modifiedRate() Use the modifiedRate() method in the Financial\CashFlow\Variable\Periodic class instead

- Parameters

-

mixed $values An array or a reference to cells that contain a series of payments and income occurring at regular intervals. Payments are negative value, income is positive values. mixed $finance_rate The interest rate you pay on the money used in the cash flows mixed $reinvestment_rate The interest rate you receive on the cash flows as you reinvest them

- Returns

- float|string Result, or a string containing an error

Definition at line 844 of file Financial.php.

References $values, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Variable\Periodic\modifiedRate().

Here is the call graph for this function:

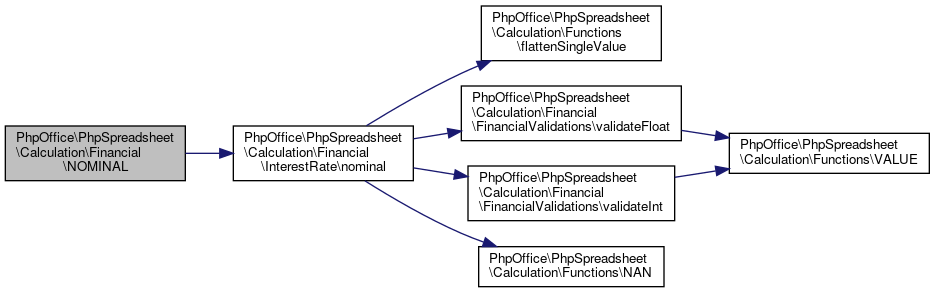

Here is the call graph for this function:◆ NOMINAL()

|

static |

NOMINAL.

Returns the nominal interest rate given the effective rate and the number of compounding payments per year.

Excel Function: NOMINAL(effect_rate, npery)

@Deprecated 1.18.0

- See also

- Financial\InterestRate::nominal() Use the nominal() method in the Financial\InterestRate class instead

- Parameters

-

float $effectiveRate Effective interest rate int $periodsPerYear Number of compounding payments per year

- Returns

- float|string Result, or a string containing an error

Definition at line 867 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\InterestRate\nominal().

Here is the call graph for this function:

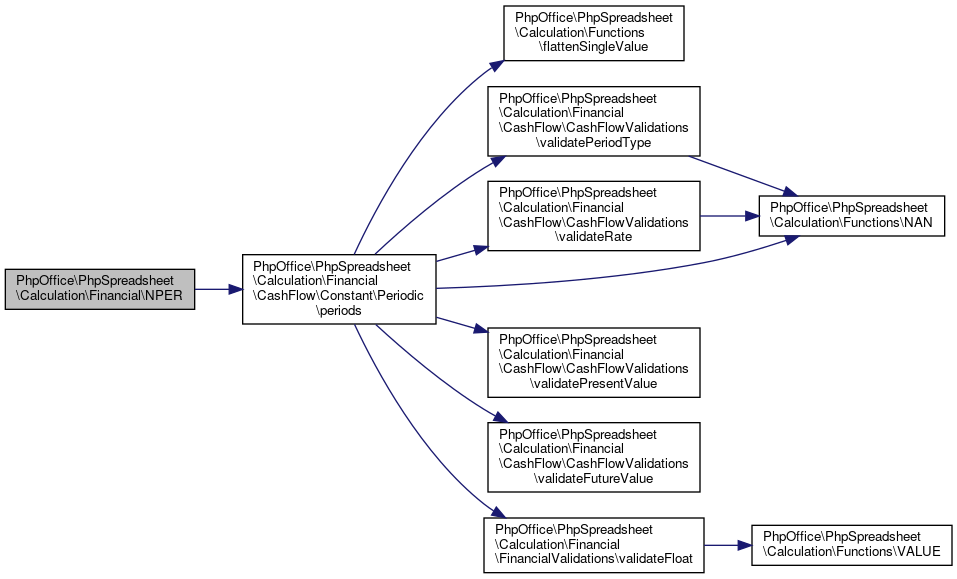

Here is the call graph for this function:◆ NPER()

|

static |

NPER.

Returns the number of periods for a cash flow with constant periodic payments (annuities), and interest rate.

@Deprecated 1.18.0

- Parameters

-

float $rate Interest rate per period int $pmt Periodic payment (annuity) float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float|string Result, or a string containing an error

- See also

- Financial\CashFlow\Constant\Periodic::periods() Use the periods() method in the Financial\CashFlow\Constant\Periodic class instead

Definition at line 890 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\periods().

Here is the call graph for this function:

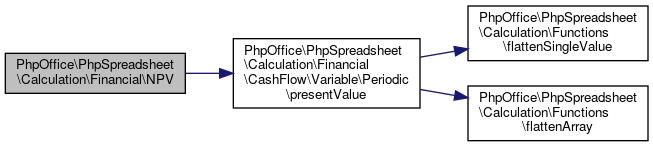

Here is the call graph for this function:◆ NPV()

|

static |

NPV.

Returns the Net Present Value of a cash flow series given a discount rate.

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Variable\Periodic::presentValue() Use the presentValue() method in the Financial\CashFlow\Variable\Periodic class instead

- Returns

- float

Definition at line 907 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Variable\Periodic\presentValue().

Here is the call graph for this function:

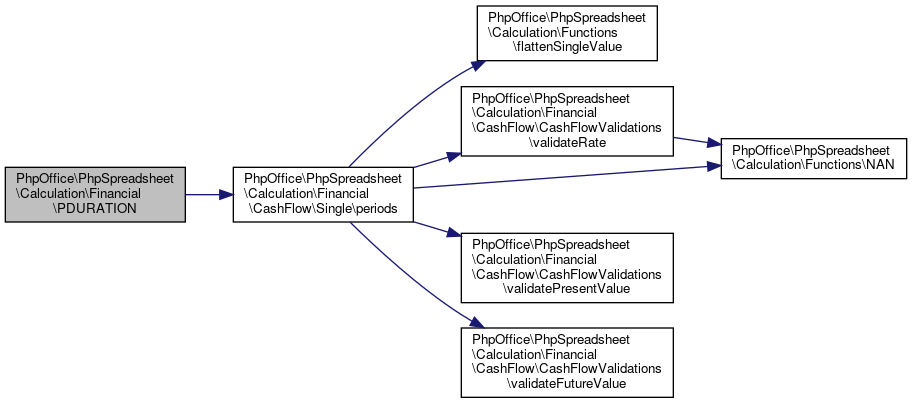

Here is the call graph for this function:◆ PDURATION()

|

static |

PDURATION.

Calculates the number of periods required for an investment to reach a specified value.

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Single::periods() Use the periods() method in the Financial\CashFlow\Single class instead

- Parameters

-

float $rate Interest rate per period float $pv Present Value float $fv Future Value

- Returns

- float|string Result, or a string containing an error

Definition at line 928 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Single\periods().

Here is the call graph for this function:

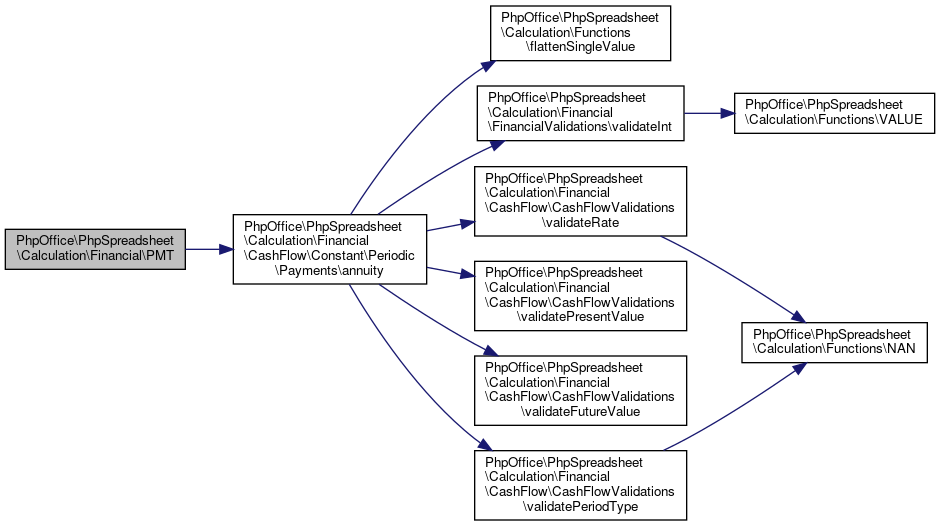

Here is the call graph for this function:◆ PMT()

|

static |

PMT.

Returns the constant payment (annuity) for a cash flow with a constant interest rate.

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Payments::annuity() Use the annuity() method in the Financial\CashFlow\Constant\Periodic\Payments class instead

- Parameters

-

float $rate Interest rate per period int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float|string Result, or a string containing an error

Definition at line 951 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Payments\annuity().

Here is the call graph for this function:

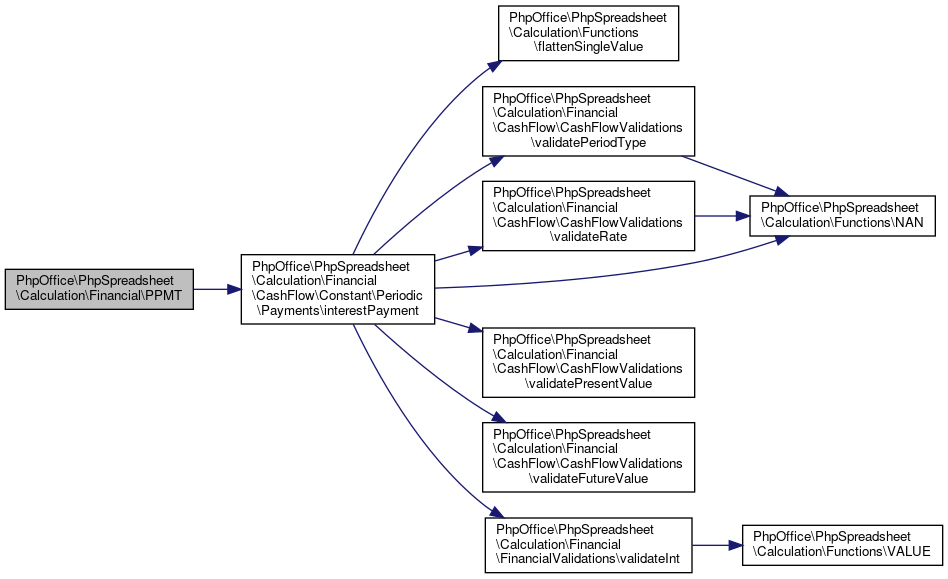

Here is the call graph for this function:◆ PPMT()

|

static |

PPMT.

Returns the interest payment for a given period for an investment based on periodic, constant payments and a constant interest rate.

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Payments::interestPayment() Use the interestPayment() method in the Financial\CashFlow\Constant\Periodic\Payments class instead

- Parameters

-

float $rate Interest rate per period int $per Period for which we want to find the interest int $nper Number of periods float $pv Present Value float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float|string Result, or a string containing an error

Definition at line 976 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Payments\interestPayment().

Here is the call graph for this function:

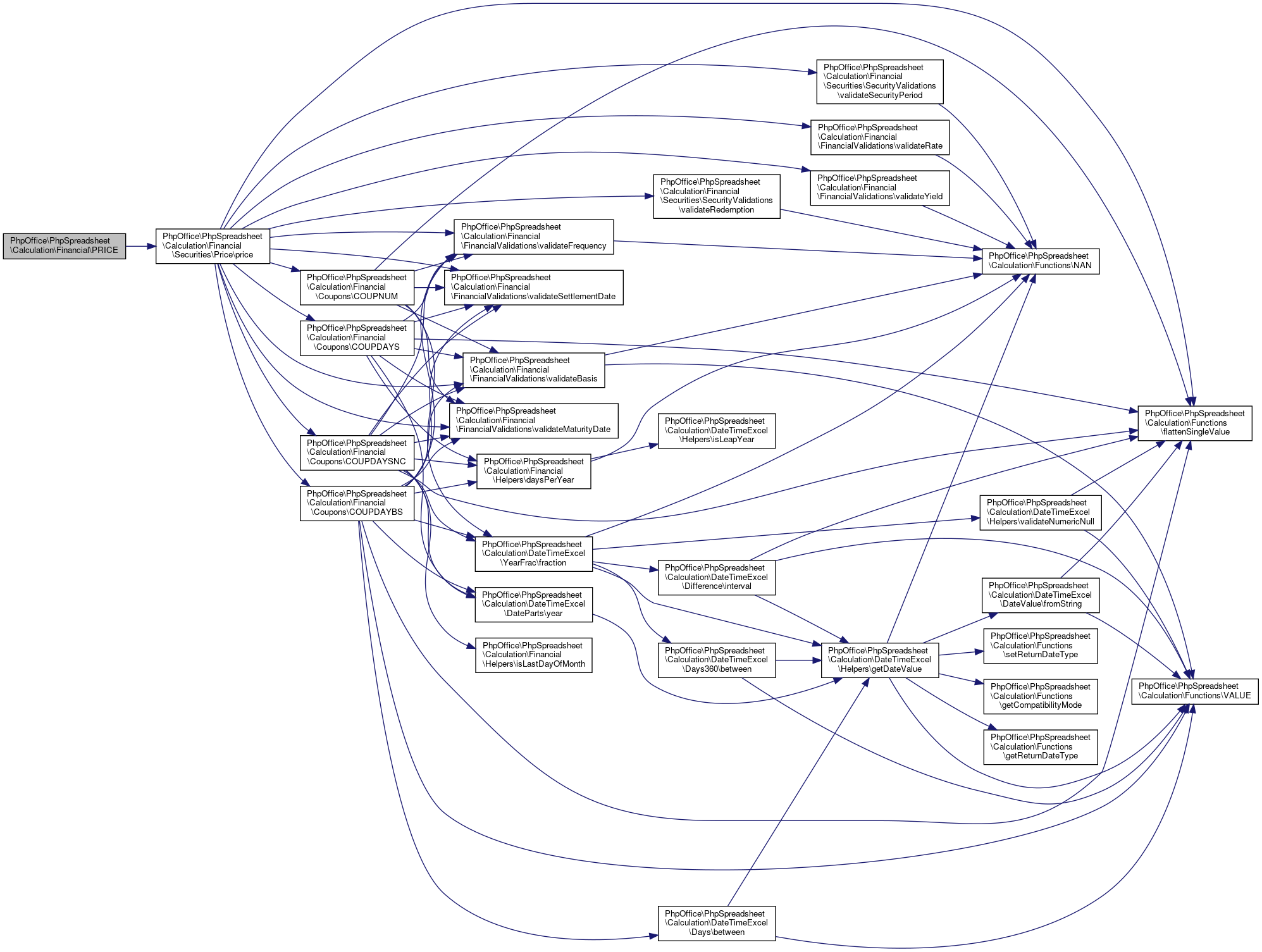

Here is the call graph for this function:◆ PRICE()

|

static |

PRICE.

Returns the price per $100 face value of a security that pays periodic interest.

@Deprecated 1.18.0

- See also

- Financial\Securities\Price::price() Use the price() method in the Financial\Securities\Price class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. float $rate the security's annual coupon rate float $yield the security's annual yield float $redemption The number of coupon payments per year. For annual payments, frequency = 1; for semiannual, frequency = 2; for quarterly, frequency = 4. int $frequency int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1012 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Price\price().

Here is the call graph for this function:

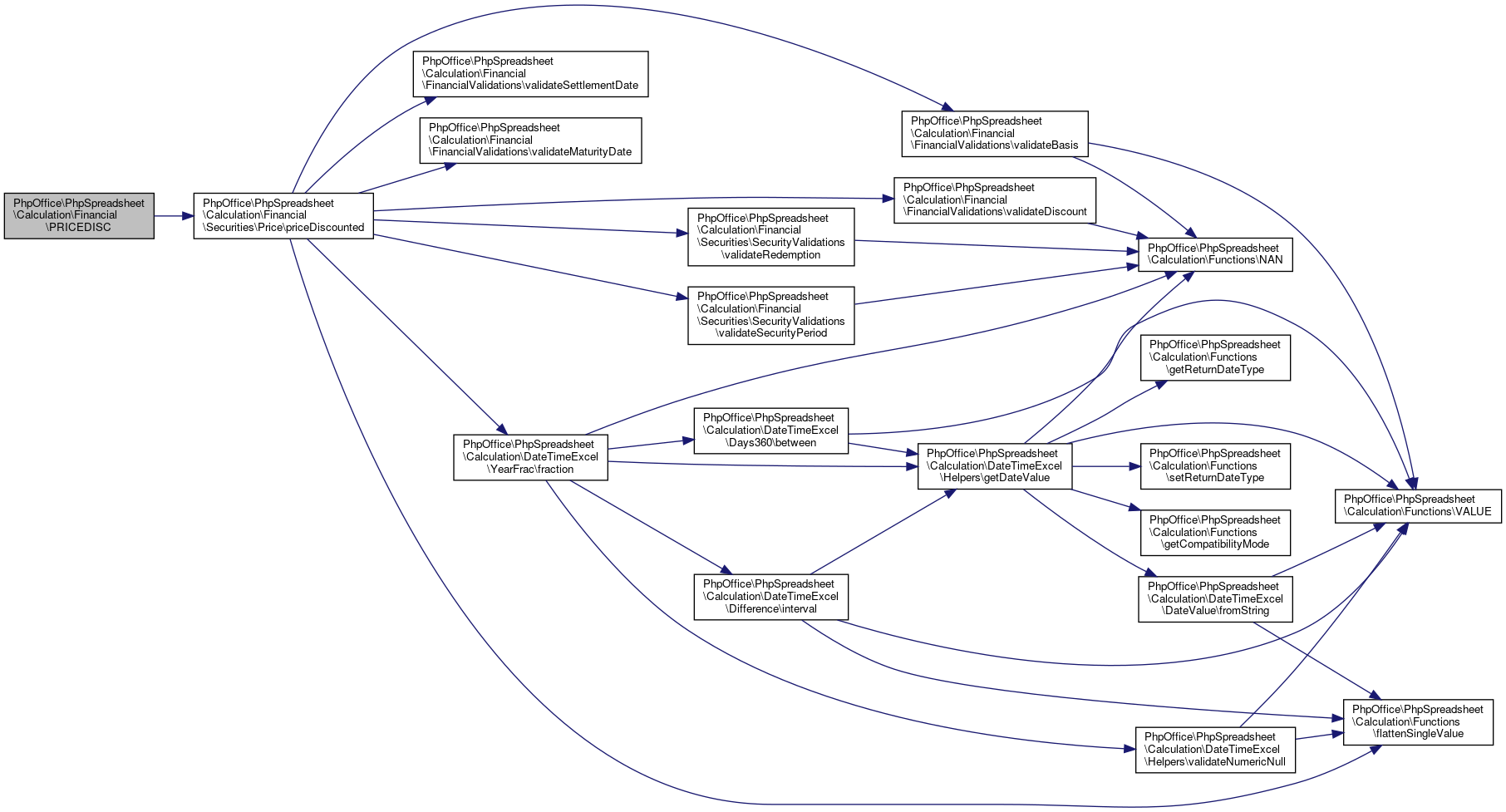

Here is the call graph for this function:◆ PRICEDISC()

|

static |

PRICEDISC.

Returns the price per $100 face value of a discounted security.

@Deprecated 1.18.0

- See also

- Financial\Securities\Price::priceDiscounted() Use the priceDiscounted() method in the Financial\Securities\Price class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. int $discount The security's discount rate int $redemption The security's redemption value per $100 face value int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1043 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Price\priceDiscounted().

Here is the call graph for this function:

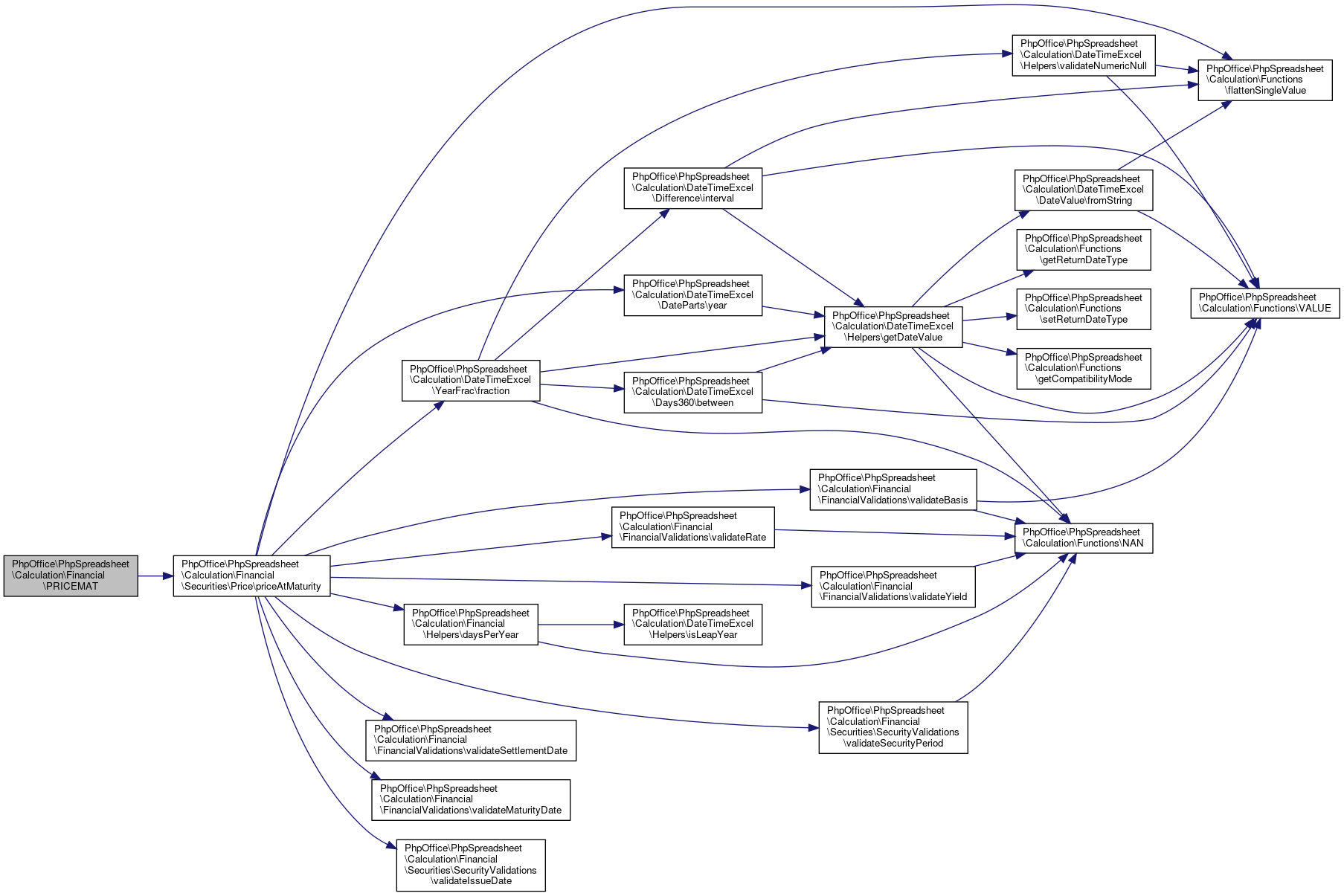

Here is the call graph for this function:◆ PRICEMAT()

|

static |

PRICEMAT.

Returns the price per $100 face value of a security that pays interest at maturity.

@Deprecated 1.18.0

- See also

- Financial\Securities\Price::priceAtMaturity() Use the priceAtMaturity() method in the Financial\Securities\Price class instead

- Parameters

-

mixed $settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $issue The security's issue date int $rate The security's interest rate at date of issue int $yield The security's annual yield int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1075 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Price\priceAtMaturity().

Here is the call graph for this function:

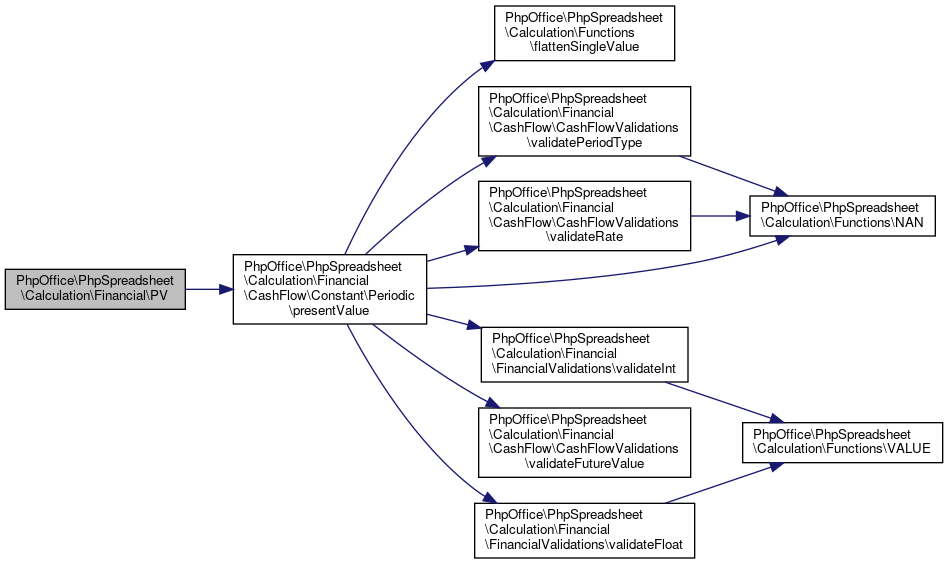

Here is the call graph for this function:◆ PV()

|

static |

PV.

Returns the Present Value of a cash flow with constant payments and interest rate (annuities).

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic::presentValue() Use the presentValue() method in the Financial\CashFlow\Constant\Periodic class instead

- Parameters

-

float $rate Interest rate per period int $nper Number of periods float $pmt Periodic payment (annuity) float $fv Future Value int $type Payment type: 0 = at the end of each period, 1 = at the beginning of each period

- Returns

- float|string Result, or a string containing an error

Definition at line 1098 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\presentValue().

Here is the call graph for this function:

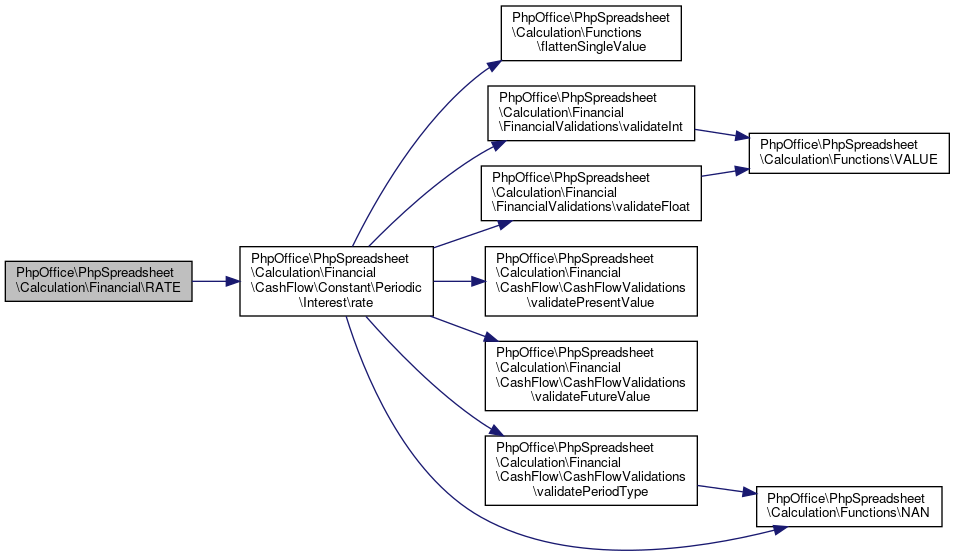

Here is the call graph for this function:◆ RATE()

|

static |

RATE.

Returns the interest rate per period of an annuity. RATE is calculated by iteration and can have zero or more solutions. If the successive results of RATE do not converge to within 0.0000001 after 20 iterations, RATE returns the #NUM! error value.

Excel Function: RATE(nper,pmt,pv[,fv[,type[,guess]]])

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Constant\Periodic\Interest::rate() Use the rate() method in the Financial\CashFlow\Constant\Periodic class instead

- Parameters

-

mixed $nper The total number of payment periods in an annuity mixed $pmt The payment made each period and cannot change over the life of the annuity. Typically, pmt includes principal and interest but no other fees or taxes. mixed $pv The present value - the total amount that a series of future payments is worth now mixed $fv The future value, or a cash balance you want to attain after the last payment is made. If fv is omitted, it is assumed to be 0 (the future value of a loan, for example, is 0). mixed $type A number 0 or 1 and indicates when payments are due: 0 or omitted At the end of the period. 1 At the beginning of the period. mixed $guess Your guess for what the rate will be. If you omit guess, it is assumed to be 10 percent.

- Returns

- float|string

Definition at line 1137 of file Financial.php.

References $type, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Constant\Periodic\Interest\rate().

Here is the call graph for this function:

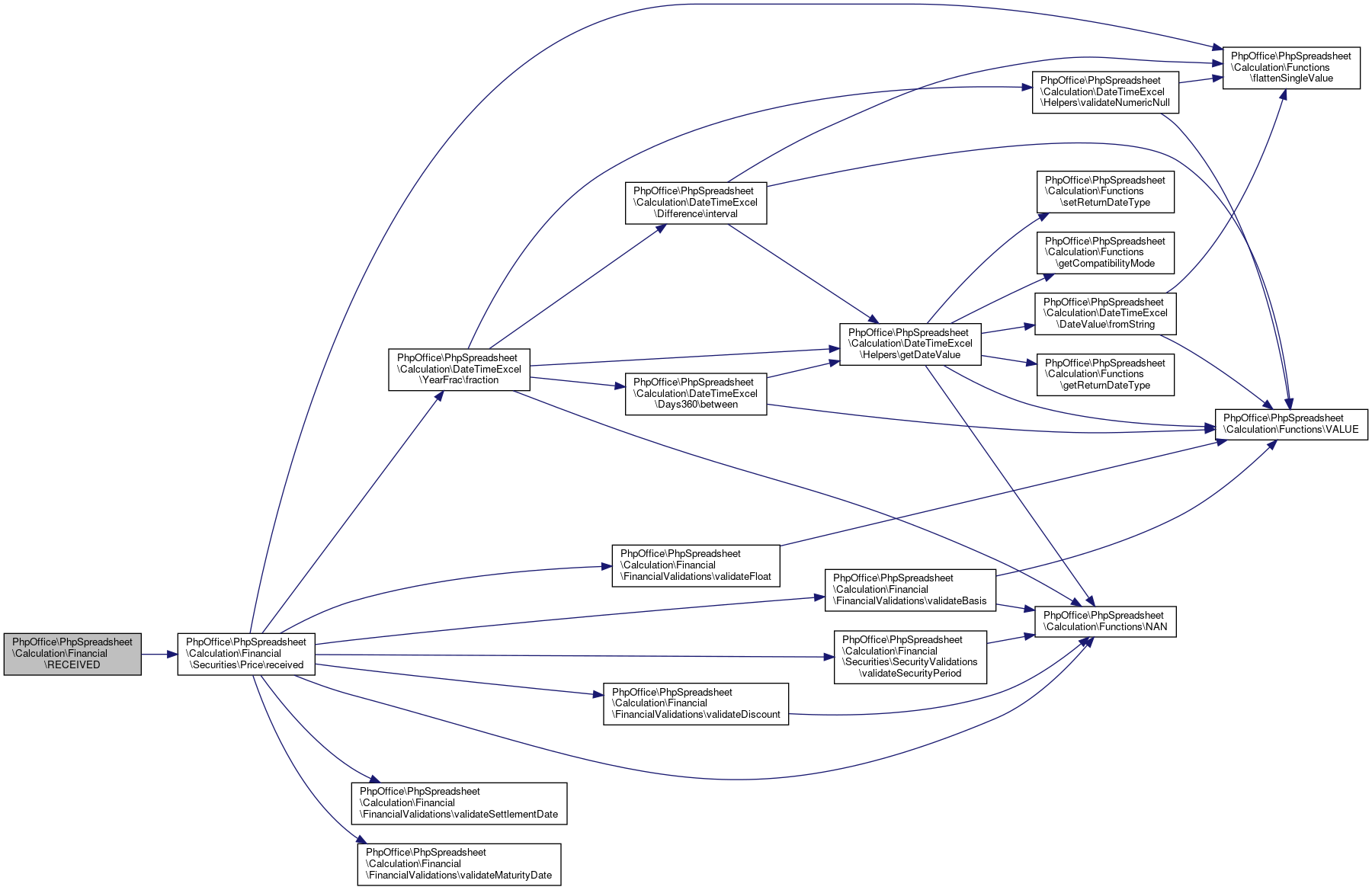

Here is the call graph for this function:◆ RECEIVED()

|

static |

RECEIVED.

Returns the amount received at maturity for a fully invested Security.

@Deprecated 1.18.0

- See also

- Financial\Securities\Price::received() Use the received() method in the Financial\Securities\Price class instead

- Parameters

-

mixed $settlement The security's settlement date. The security settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $investment The amount invested in the security mixed $discount The security's discount rate mixed $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1168 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Price\received().

Here is the call graph for this function:

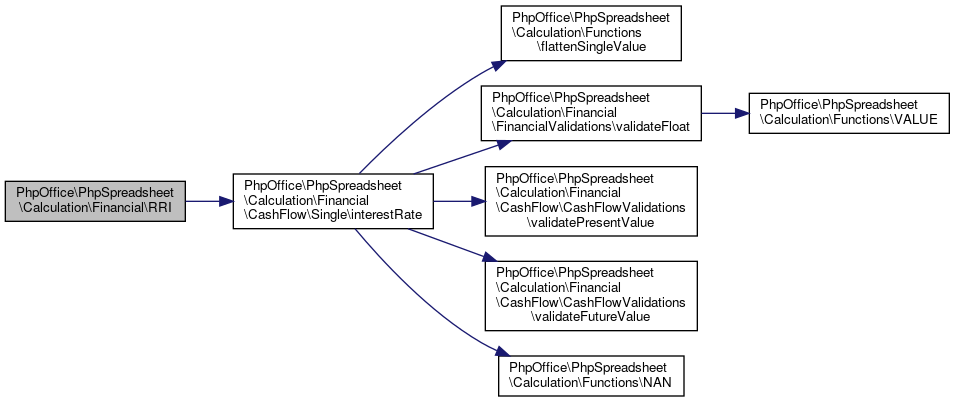

Here is the call graph for this function:◆ RRI()

|

static |

RRI.

Calculates the interest rate required for an investment to grow to a specified future value .

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Single::interestRate() Use the interestRate() method in the Financial\CashFlow\Single class instead

- Parameters

-

float $nper The number of periods over which the investment is made float $pv Present Value float $fv Future Value

- Returns

- float|string Result, or a string containing an error

Definition at line 1189 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Single\interestRate().

Here is the call graph for this function:

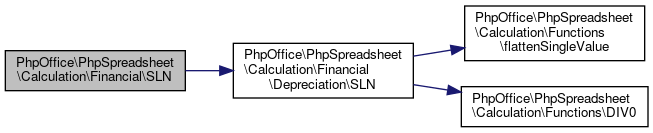

Here is the call graph for this function:◆ SLN()

|

static |

SLN.

Returns the straight-line depreciation of an asset for one period

@Deprecated 1.18.0

- See also

- Financial\Depreciation::SLN() Use the SLN() method in the Financial\Depreciation class instead

- Parameters

-

mixed $cost Initial cost of the asset mixed $salvage Value at the end of the depreciation mixed $life Number of periods over which the asset is depreciated

- Returns

- float|string Result, or a string containing an error

Definition at line 1210 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Depreciation\SLN().

Here is the call graph for this function:

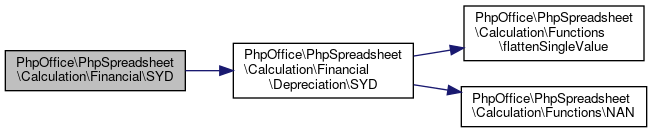

Here is the call graph for this function:◆ SYD()

|

static |

SYD.

Returns the sum-of-years' digits depreciation of an asset for a specified period.

@Deprecated 1.18.0

- See also

- Financial\Depreciation::SYD() Use the SYD() method in the Financial\Depreciation class instead

- Parameters

-

mixed $cost Initial cost of the asset mixed $salvage Value at the end of the depreciation mixed $life Number of periods over which the asset is depreciated mixed $period Period

- Returns

- float|string Result, or a string containing an error

Definition at line 1232 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Depreciation\SYD().

Here is the call graph for this function:

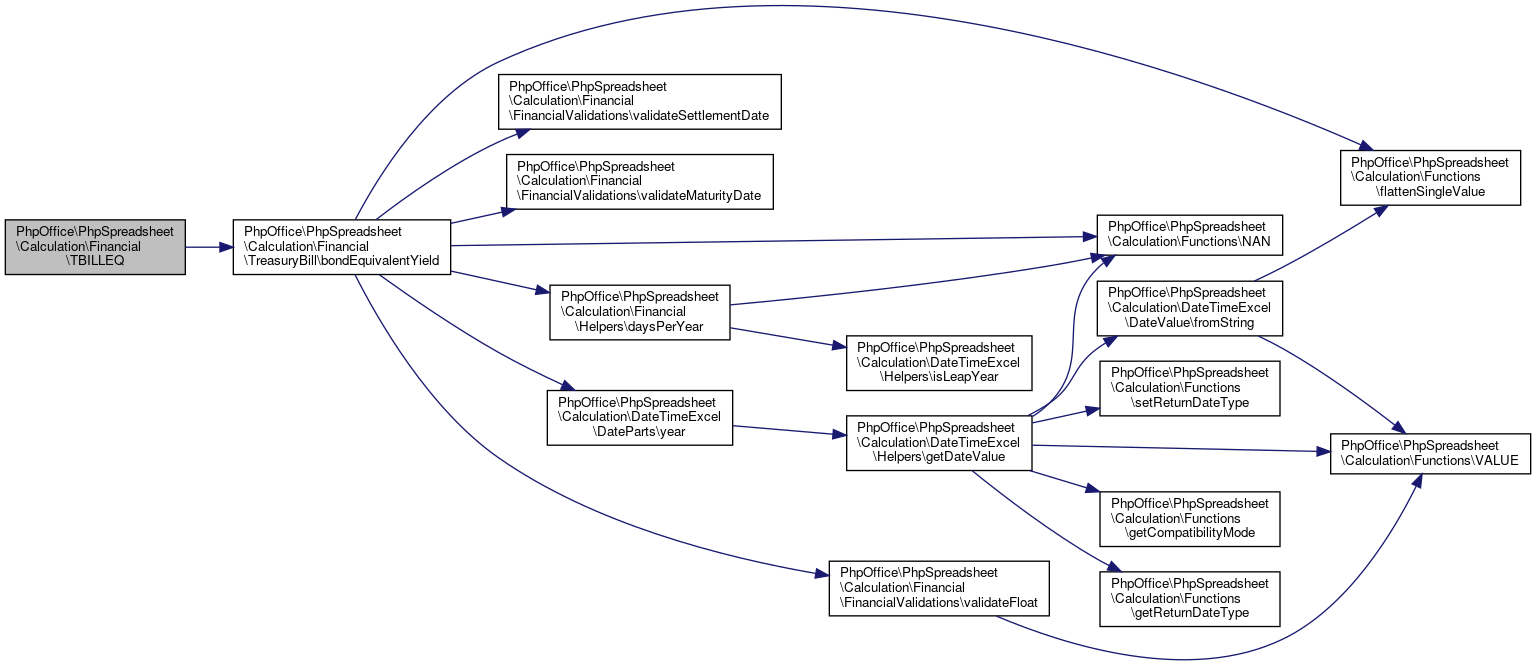

Here is the call graph for this function:◆ TBILLEQ()

|

static |

TBILLEQ.

Returns the bond-equivalent yield for a Treasury bill.

@Deprecated 1.18.0

- See also

- Financial\TreasuryBill::bondEquivalentYield() Use the bondEquivalentYield() method in the Financial\TreasuryBill class instead

- Parameters

-

mixed $settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed $maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int $discount The Treasury bill's discount rate

- Returns

- float|string Result, or a string containing an error

Definition at line 1256 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\TreasuryBill\bondEquivalentYield().

Here is the call graph for this function:

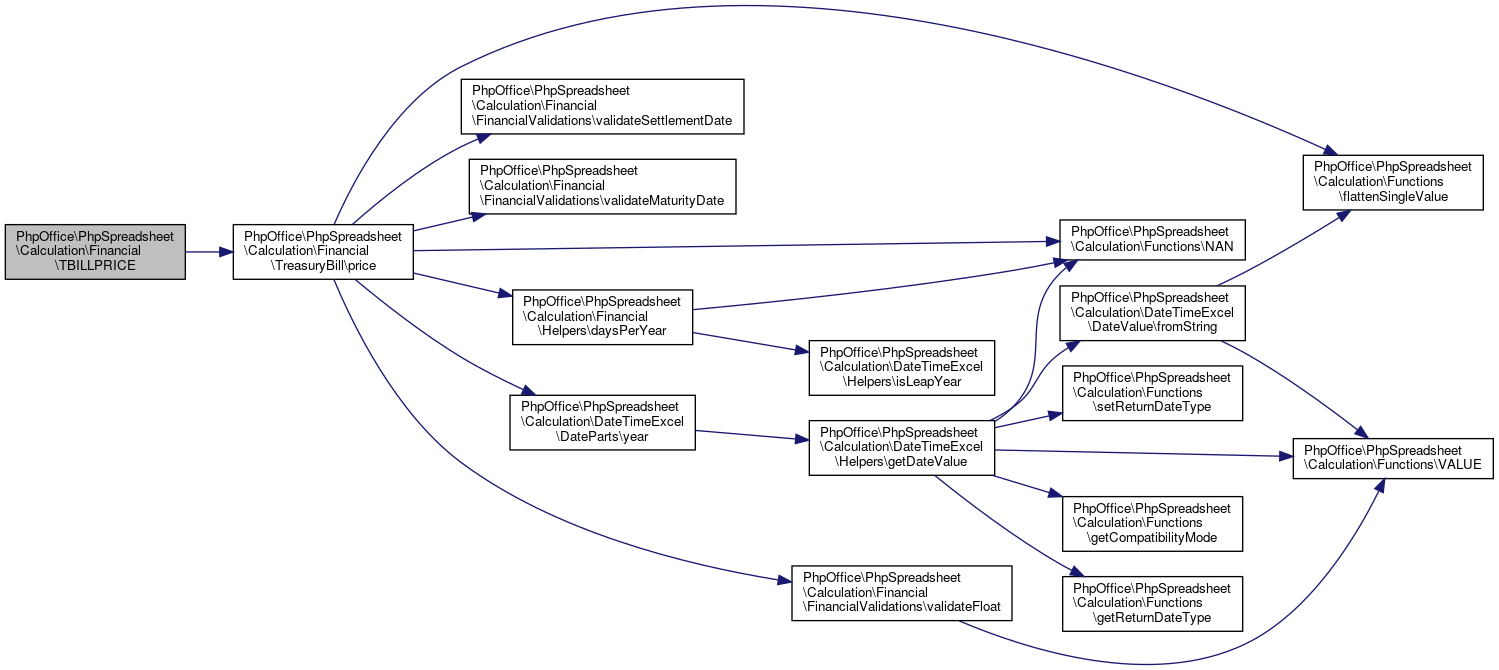

Here is the call graph for this function:◆ TBILLPRICE()

|

static |

TBILLPRICE.

Returns the price per $100 face value for a Treasury bill.

@Deprecated 1.18.0

- See also

- Financial\TreasuryBill::price() Use the price() method in the Financial\TreasuryBill class instead

- Parameters

-

mixed $settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed $maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int $discount The Treasury bill's discount rate

- Returns

- float|string Result, or a string containing an error

Definition at line 1280 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\TreasuryBill\price().

Here is the call graph for this function:

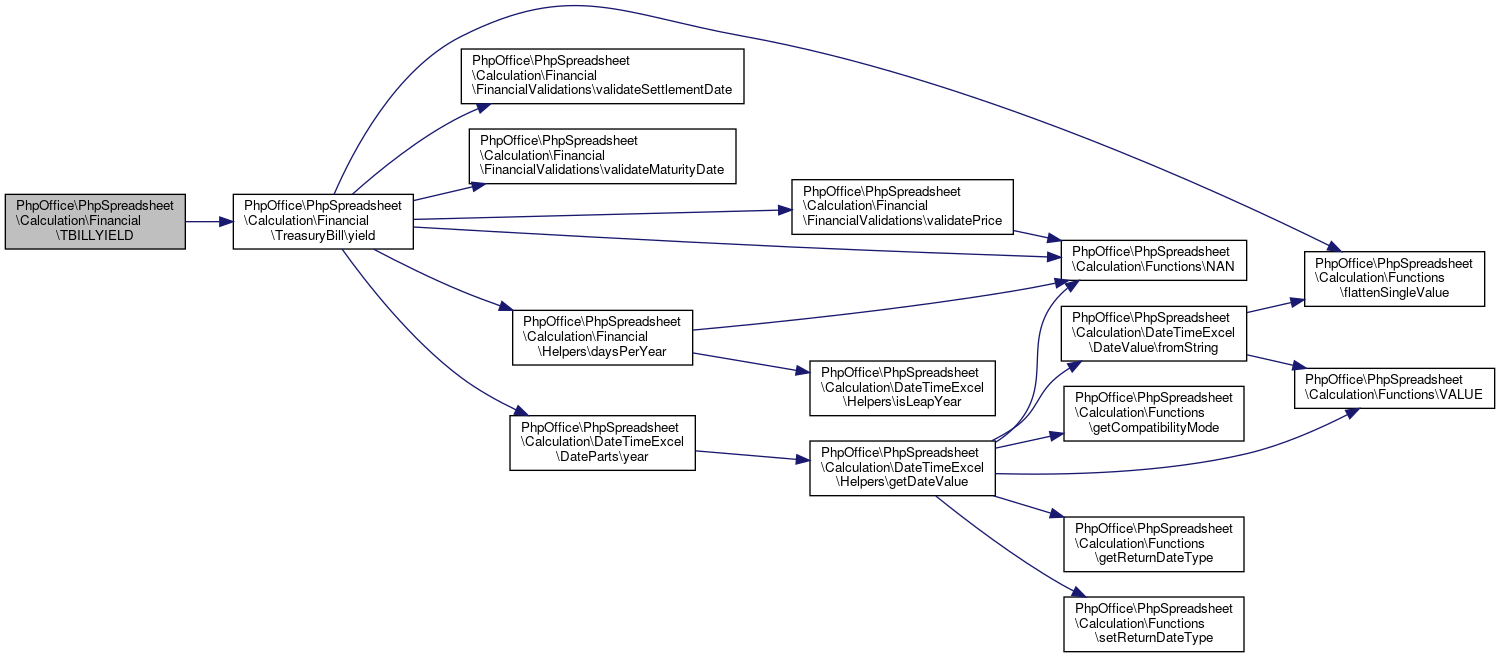

Here is the call graph for this function:◆ TBILLYIELD()

|

static |

TBILLYIELD.

Returns the yield for a Treasury bill.

@Deprecated 1.18.0

- See also

- Financial\TreasuryBill::yield() Use the yield() method in the Financial\TreasuryBill class instead

- Parameters

-

mixed $settlement The Treasury bill's settlement date. The Treasury bill's settlement date is the date after the issue date when the Treasury bill is traded to the buyer. mixed $maturity The Treasury bill's maturity date. The maturity date is the date when the Treasury bill expires. int $price The Treasury bill's price per $100 face value

- Returns

- float|mixed|string

Definition at line 1304 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\TreasuryBill\yield().

Here is the call graph for this function:

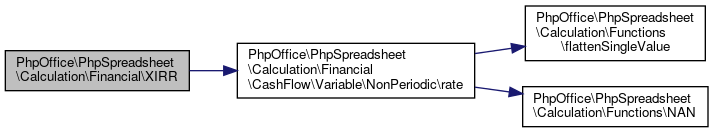

Here is the call graph for this function:◆ XIRR()

|

static |

XIRR.

Returns the internal rate of return for a schedule of cash flows that is not necessarily periodic.

Excel Function: =XIRR(values,dates,guess)

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Variable\NonPeriodic::rate() Use the rate() method in the Financial\CashFlow\Variable\NonPeriodic class instead

- Parameters

-

float[] $values A series of cash flow payments The series of values must contain at least one positive value & one negative value mixed[] $dates A series of payment dates The first payment date indicates the beginning of the schedule of payments All other dates must be later than this date, but they may occur in any order float $guess An optional guess at the expected answer

- Returns

- float|mixed|string

Definition at line 1331 of file Financial.php.

References $values, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Variable\NonPeriodic\rate().

Here is the call graph for this function:

Here is the call graph for this function:◆ XNPV()

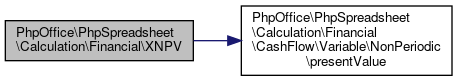

|

static |

XNPV.

Returns the net present value for a schedule of cash flows that is not necessarily periodic. To calculate the net present value for a series of cash flows that is periodic, use the NPV function.

Excel Function: =XNPV(rate,values,dates)

@Deprecated 1.18.0

- See also

- Financial\CashFlow\Variable\NonPeriodic::presentValue() Use the presentValue() method in the Financial\CashFlow\Variable\NonPeriodic class instead

- Parameters

-

float $rate the discount rate to apply to the cash flows float[] $values A series of cash flows that corresponds to a schedule of payments in dates. The first payment is optional and corresponds to a cost or payment that occurs at the beginning of the investment. If the first value is a cost or payment, it must be a negative value. All succeeding payments are discounted based on a 365-day year. The series of values must contain at least one positive value and one negative value. mixed[] $dates A schedule of payment dates that corresponds to the cash flow payments. The first payment date indicates the beginning of the schedule of payments. All other dates must be later than this date, but they may occur in any order.

- Returns

- float|mixed|string

Definition at line 1363 of file Financial.php.

References $values, and PhpOffice\PhpSpreadsheet\Calculation\Financial\CashFlow\Variable\NonPeriodic\presentValue().

Here is the call graph for this function:

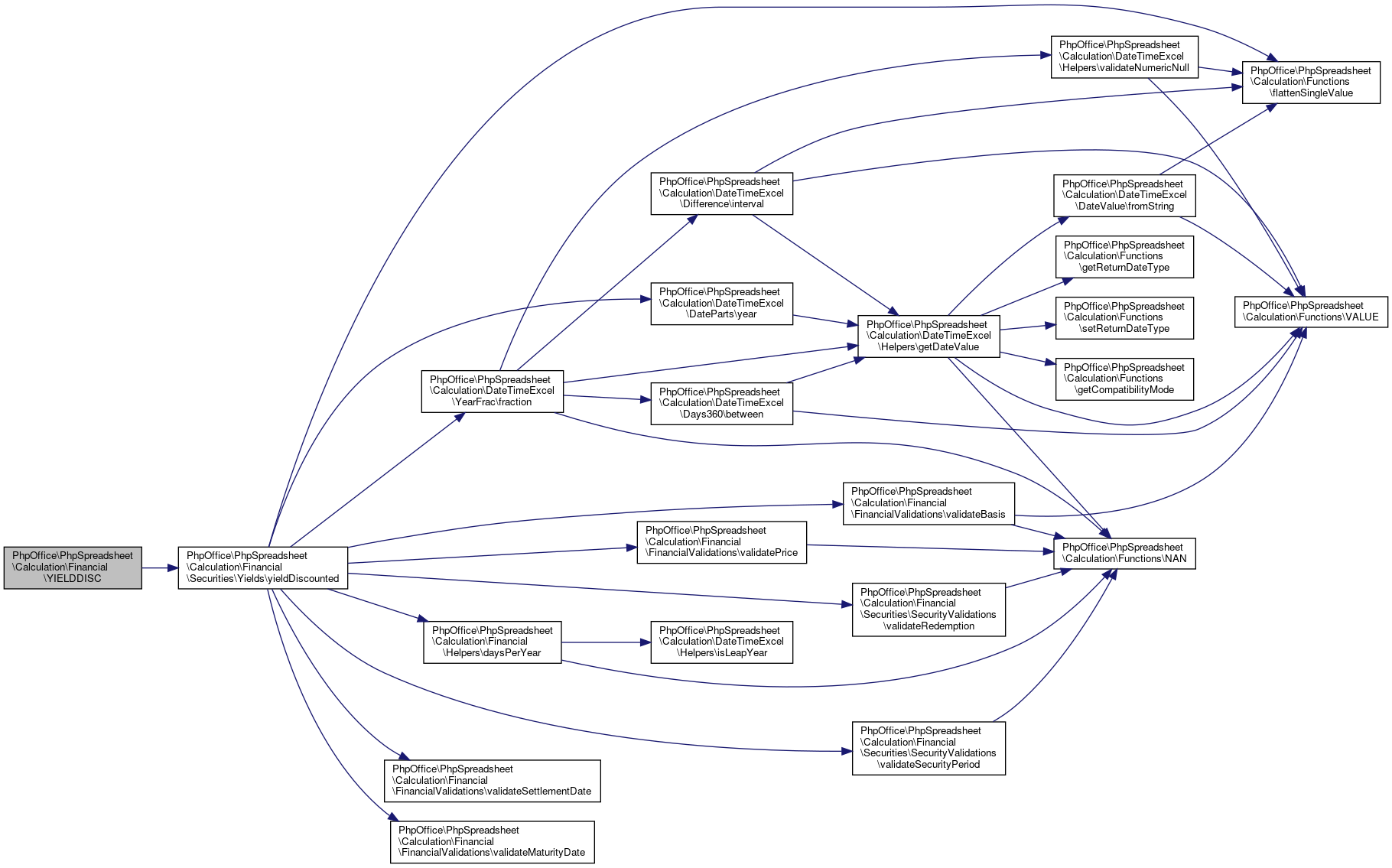

Here is the call graph for this function:◆ YIELDDISC()

|

static |

YIELDDISC.

Returns the annual yield of a security that pays interest at maturity.

@Deprecated 1.18.0

- See also

- Financial\Securities\Yields::yieldDiscounted() Use the yieldDiscounted() method in the Financial\Securities\Yields class instead

- Parameters

-

mixed $settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. int $price The security's price per $100 face value int $redemption The security's redemption value per $100 face value int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1394 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Yields\yieldDiscounted().

Here is the call graph for this function:

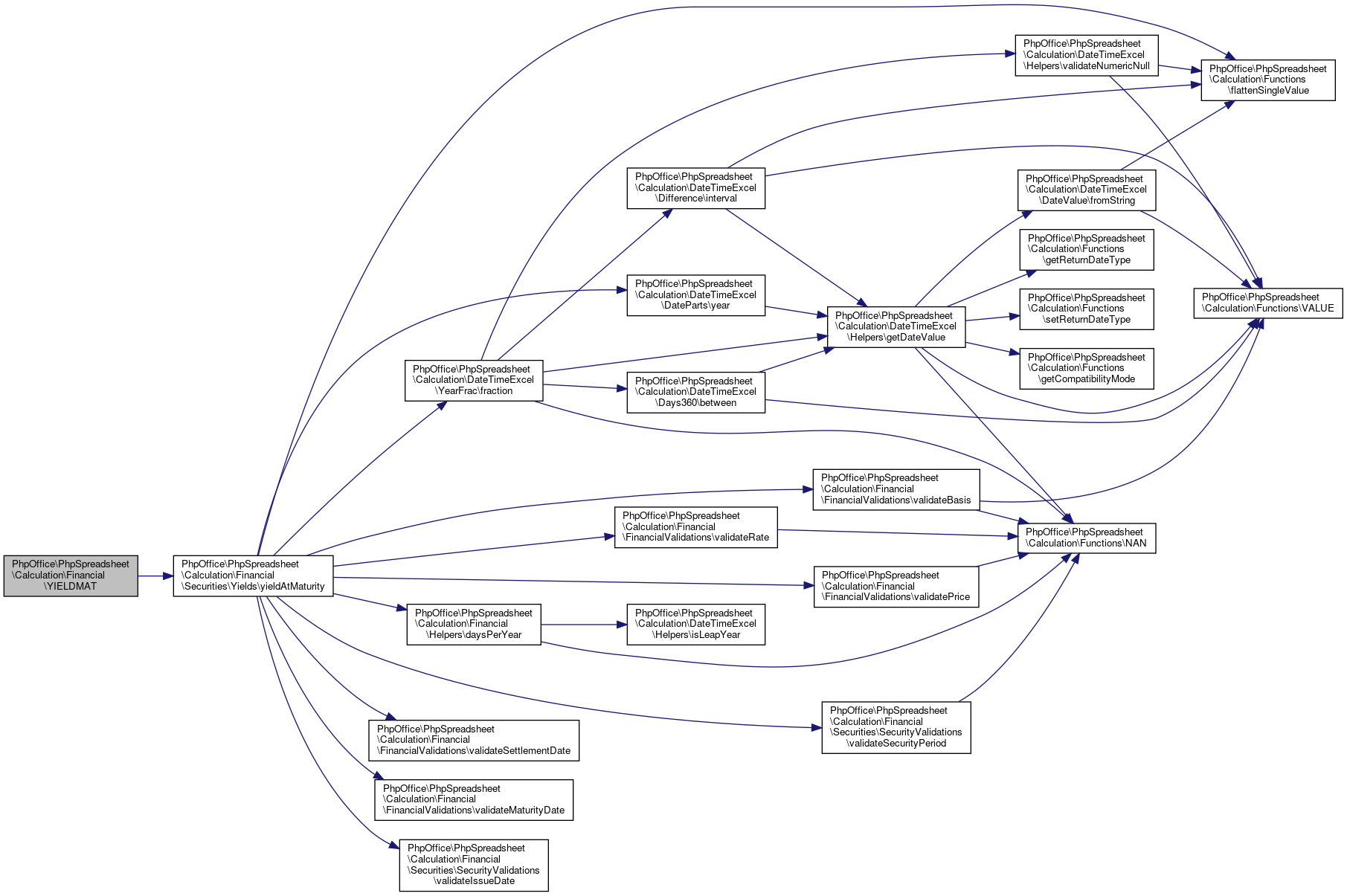

Here is the call graph for this function:◆ YIELDMAT()

|

static |

YIELDMAT.

Returns the annual yield of a security that pays interest at maturity.

@Deprecated 1.18.0

- See also

- Financial\Securities\Yields::yieldAtMaturity() Use the yieldAtMaturity() method in the Financial\Securities\Yields class instead

- Parameters

-

mixed $settlement The security's settlement date. The security's settlement date is the date after the issue date when the security is traded to the buyer. mixed $maturity The security's maturity date. The maturity date is the date when the security expires. mixed $issue The security's issue date int $rate The security's interest rate at date of issue int $price The security's price per $100 face value int $basis The type of day count to use. 0 or omitted US (NASD) 30/360 1 Actual/actual 2 Actual/360 3 Actual/365 4 European 30/360

- Returns

- float|string Result, or a string containing an error

Definition at line 1426 of file Financial.php.

References PhpOffice\PhpSpreadsheet\Calculation\Financial\Securities\Yields\yieldAtMaturity().

Here is the call graph for this function:

Here is the call graph for this function:Field Documentation

◆ FINANCIAL_MAX_ITERATIONS

| const PhpOffice\PhpSpreadsheet\Calculation\Financial::FINANCIAL_MAX_ITERATIONS = 128 |

Definition at line 18 of file Financial.php.

◆ FINANCIAL_PRECISION

| const PhpOffice\PhpSpreadsheet\Calculation\Financial::FINANCIAL_PRECISION = 1.0e-08 |

Definition at line 20 of file Financial.php.

The documentation for this class was generated from the following file:

- libs/composer/vendor/phpoffice/phpspreadsheet/src/PhpSpreadsheet/Calculation/Financial.php